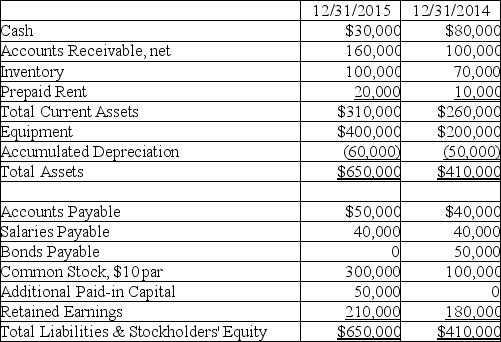

Matthauson Company has the following comparative balance sheet data available:

Additional information:

Additional information:

1.The company reports net income of $100,000 and Depreciation Expense of $20,000 for the year ending December 31,2015.

2.Dividends declared and paid in 2015,$70,000.

3.Equipment with a cost of $20,000,with Accumulated Depreciation of $10,000 was sold for $3,000.

4.New equipment was purchased for cash.

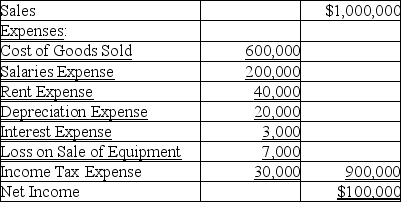

The company also reports the following income statement for the year ending December 31,2015:

Using the direct method,prepare the statement of cash flows for the year ending December 31,2015.

Using the direct method,prepare the statement of cash flows for the year ending December 31,2015.

Definitions:

Dual Agency

A real estate transaction scenario in which a single agent or broker represents both the buyer and the seller, creating potential conflicts of interest.

Fiduciary Duty

A legal obligation of one party to act in the best interest of another when managing another person’s assets, involving a relationship of trust and confidence.

Independent Contractor

An individual or entity contracted to perform work for another entity as a non-employee, responsible for their own taxes and benefits.

Agent

Someone who is authorized to act on behalf of another person (the principal), especially in business or legal matters.

Q9: Which statement about the statement of cash

Q31: Mews Corporation has the following information reported

Q64: Following U.S.GAAP,the carrying value of a building

Q67: Red flags in financial statement analysis can

Q83: Flanders Company has total assets of $360,000

Q112: A book value per share of common

Q118: What do the price-earnings ratio and dividend

Q137: How does the declaration and distribution of

Q139: Characteristics of faithfully representative information do NOT

Q153: Factors that reflect the ability of a