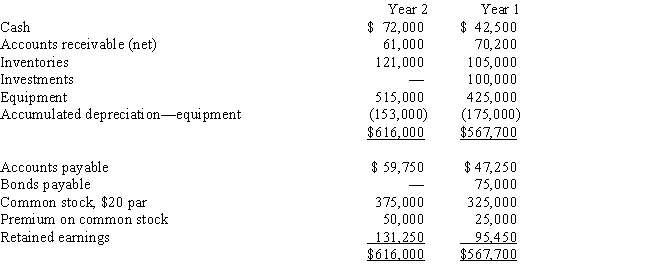

The comparative balance sheet of Barry Company for Years 1 and 2 ended December 31 appears below in condensed form:

Additional data for the current year are as follows: (a) Net income, .

(b) Depreciation reported on income statement, .

(c) Fully depreciated equipment costing was scrapped, no salvage, and equipment was purchased for .

(d) Bonds payable for were retired by payment at their face amount.

(e) 2,500 shares of common stock were issued at for cash.

(f) Cash dividends declared and paid, .

(g) Investments of were sold for .

Prepare a statement of cash flows using the indirect method.

Definitions:

Current Price

The present market value or cost at which an asset, product, or security can be bought or sold.

TRIN Ratio

A technical analysis indicator that compares advancing and declining stock issues and volume to assess market sentiment.

Market Breadth

An indicator used to gauge the direction of the overall stock market by analyzing the number of companies advancing versus those declining.

50-day Moving Average

A technical analysis indicator that represents the average closing price of a security over the most recent 50-day period, used to gauge short-term price trends.

Q11: At the end of the current accounting

Q55: The net increase or decrease in Retained

Q68: An installment note is a debt that

Q76: The journal entry a company records for

Q128: Glover Corporation issued $2,000,000 of 7.5%, 6-year

Q139: On January 1 of the current year,

Q166: If a business issued bonds payable in

Q167: What is the total stockholders' equity

Q192: The number of shares of outstanding stock

Q199: Comparative information taken from the Friction