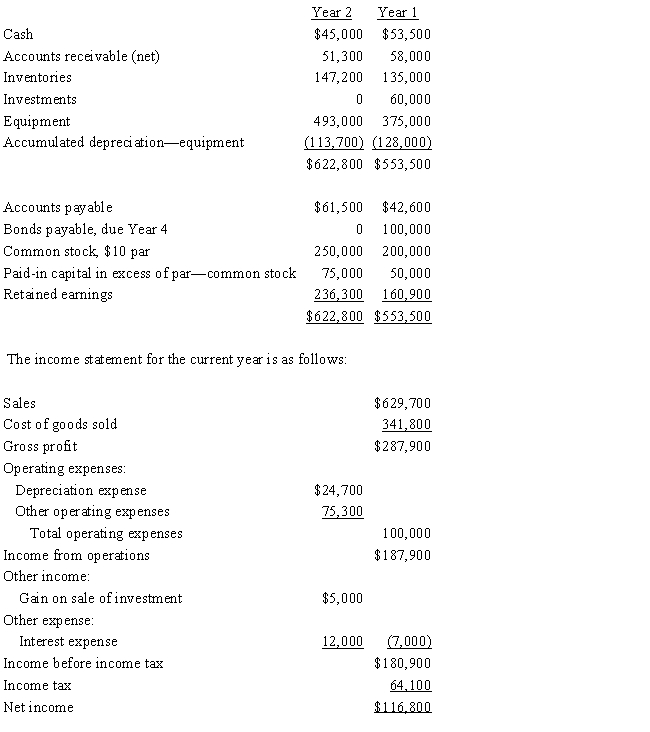

The comparative balance sheet of ConnieJo Company, for December 31, Years 1 and 2 ended December 31 appears below in condensed form:

Additional data for the current year are as follows:

(a) Fully depreci ated equipment costing was scrapped, no salvage, and equipment was purchased for .

(b) Bonds payable for were retired by payment at their face amount.

(c) 5,000 shares of common stock were issued at for cash.

(d) Cash dividends declared were paid .

(e) All sales are on account.

Prepare a statement of cash flows, using the indirect method of reporting cash flows from operating activities.

Definitions:

Equity Method

An accounting technique used to record investments in other companies where the investor has significant influence but does not control the company outright.

Consolidation Method

An accounting technique used for combining the financial statements of subsidiary companies with the parent company.

Statement of Earnings

A financial document that provides an account of a company's revenue, expenses, and profit over a specific period, also known as an income statement.

FVTPL

Fair Value Through Profit or Loss, a classification under IFRS for financial instruments measured at their fair value with changes recognized in the profit or loss.

Q7: Proper payroll accounting methods are important for

Q47: Federal income taxes withheld increase the employer's

Q57: Exchange of land for common stock<br>A)Increase cash

Q64: Amortization of intangible assets<br>A)Increase cash from operating

Q71: The Sneed Corporation issues 10,000 shares of

Q121: Federal unemployment compensation taxes that are collected

Q125: Which of the following should be added

Q129: The percent of fixed assets to total

Q149: If $500,000 of 10-year bonds, with interest

Q179: The journal entry used to record the