On January 1, Year 1, a company had the following transactions:

- Issued 10,000 shares of $2.00 par common stock for $12.00 per share.

- Issued 3,000 shares of $50 par, 6% cumulative preferred stock for $70 per share.

- Purchased 1,000 shares of previously issued common stock for $15.00 per share.

- No other shares of stock were issued or outstanding.

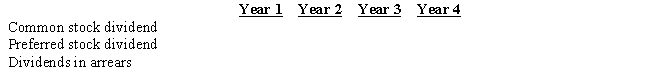

The company had the following dividend information available:

Year 1 - No dividend paid

Year 2 - Paid a $2,000 total dividend

Year 3 - Paid a $20,000 total dividend

Year 4 - Paid a $25,000 total dividend

Using the following format, fill in the correct values for each year:

Definitions:

FICA

Refers to the Federal Insurance Contributions Act tax, which is a United States federal payroll tax imposed on both employees and employers to fund Social Security and Medicare.

Unemployment Taxes

Unemployment taxes are taxes paid by employers to fund the unemployment insurance system, providing benefits to workers who have lost their jobs.

FICA-OASDI

Federal Insurance Contributions Act - Old-Age, Survivors, and Disability Insurance; a payroll tax that funds Social Security and Medicare in the United States.

Workers' Compensation

Insurance offering medical benefits and wage replacement to employees who become injured while on the job.

Q9: Cash paid for preferred stock dividends should

Q16: To determine cash payments for operating expenses

Q66: A fixed asset with a cost of

Q85: If the amount of a bond premium

Q85: Cash paid to purchase long-term investments would

Q86: The buyer determines how much to pay

Q89: Prepare entries to record the following:

Q113: Gallant Company reported net income of $2,500,000.

Q156: The cost method of accounting for the

Q221: The natural resources of some companies include<br>A)