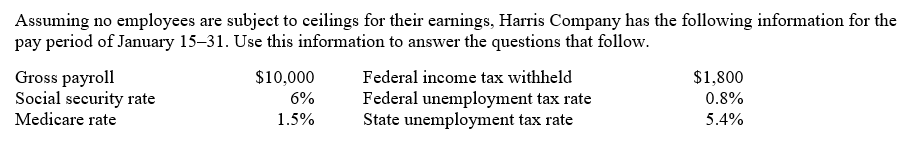

-Assume that social security taxes are payable at a 6% rate and Medicare taxes are payable at a 1.5% rate with no maximum earnings, and that federal and state unemployment compensation taxes total 6.2% on the first $7,000 of earnings. If an employee earns $2,500 for the current week and the employee's year-to-date earnings before this week were $6,800, what is the total employer payroll taxes related to the current week?

Definitions:

Chlamydia

A common sexually transmitted infection caused by the bacterium Chlamydia trachomatis, often asymptomatic but treatable with antibiotics.

Human Papillomavirus (HPV)

A group of viruses that can cause warts on the body or lead to cancers such as cervical cancer.

Cervical Cancer

A type of cancer that occurs in the cells of the cervix — the lower part of the uterus that connects to the vagina.

Human Papillomavirus (HPV)

A common virus group, some types of which can cause cancer and other diseases.

Q4: Scott Company sells merchandise with a one-year

Q34: The collection of an account that had

Q35: You have just received notice that a

Q36: A company has 10,000 shares of

Q84: The book value of bonds payable<br>A)carrying amount<br>B)face

Q123: Under the corporate form of business organization,<br>A)

Q139: The board of directors of Kendall Co.

Q198: What is the depreciation, for the year

Q212: Loss on Disposal of Asset<br>A)Current Assets<br>B)Fixed Assets<br>C)Intangible

Q248: Mathai Company has sales of $4,800,000 for