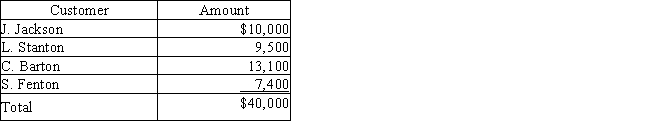

Morry Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31:

Required: (a) Journalize the write-offs for the current year under the direct write-off method.

Required: (a) Journalize the write-offs for the current year under the direct write-off method.

(b) Journalize the write-offs for the current year under the allowance method. Also, joumalize the adjusting entry for uncollectible receivables assuming the company made of credit sales during the year and the industry average for uncollectible receivables is of credit sales.

(c) How much higher or lower would Morry Company's net income have been under the direct write-off method than under the allowance method?

Definitions:

Consideration

Something of value exchanged between parties in a contract, which is required for the agreement to be legally binding.

Estopped

Barred, impeded, or precluded.

Promissory Estoppel

A legal principle that prevents a party from withdrawing a promise when the other party has relied upon it to their detriment.

Preexisting Duty

An obligation or duty that already exists under contract law and does not constitute valid consideration for a new agreement.

Q22: Blast sells portable CD players and each

Q36: A check outstanding for two consecutive months

Q77: Under a perpetual inventory system, the amount

Q91: Other receivables include nontrade receivables such as

Q100: Accumulated Depreciation-Buildings<br>A)Current Assets<br>B)Fixed Assets<br>C)Intangible Assets<br>D)Current Liability<br>E)Long-Term Liability<br>F)Owners'

Q124: The main reason that the bank statement

Q134: The equation for computing interest on an

Q174: The formula for depreciable cost is<br>A) Initial

Q193: For income tax purposes, most companies use

Q230: The units-of-output depreciation method provides a good