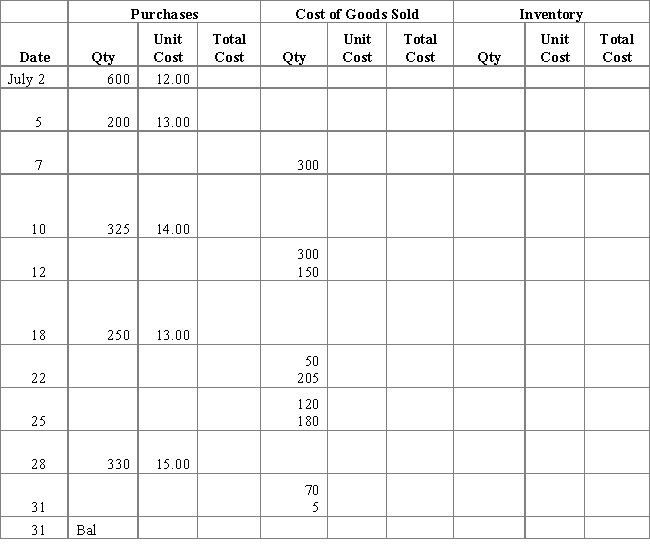

Complete the following table using the perpetual FIFO method of inventory flow.

Definitions:

Variable Costs

Costs that vary directly with the level of production output or sales volume, such as materials and labor.

Activity Level

The volume of work or the number of transactions handled by a business or department, which can drive the allocation of costs based on activity-based costing principles.

Fixed Costs

Overheads that stay the same no matter the quantity of goods produced or sold, like rent, salaries, and insurance.

Activity Level

A measure of the volume of work or production capability, often used in cost accounting to determine appropriate cost allocations.

Q5: How is the Internal Control-Integrated Framework used

Q30: Lone Star Company received a 90-day, 6%

Q45: The actual cash received during the

Q47: The type of account and normal balance

Q47: Discount Mart utilizes the allowance method of

Q77: The seller may prepay the freight costs

Q85: Calculate the gross profit for Jonas Company

Q128: President's salaries, depreciation of office furniture, and

Q181: When the allowance method is used to

Q182: Which of the following is not an