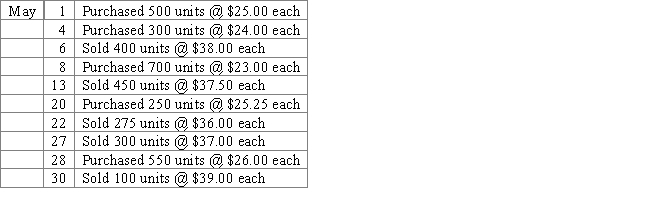

Brutus Corporation, a newly formed corporation, has the following transactions during May, its first month of operations.

-Using the table provided, calculate total sales, cost of goods sold, gross profit, and ending inventory using each of the LIFO perpetual inventory method.

Definitions:

Relevant Range

The level of activity or volume over which the specific cost assumptions (fixed and variable costs) are valid.

Total Variable Cost

The sum of all costs that vary directly with the level of production or output.

Total Fixed Cost

The sum of all costs that remain constant regardless of the level of production or business activity.

Manufacturing Overhead

The sum of all costs associated with the production process that cannot be directly traced to specific products, such as maintenance expenses, factory utilities, and property taxes; it's crucial for calculating the total cost of production.

Q20: When merchandise that was sold is returned,

Q24: Record the following purchases and sales transactions

Q36: When merchandise is sold for $600 plus

Q44: Income that cannot be associated definitely with

Q68: Financial statement data for the years ended

Q75: Balance sheet accounts<br>A) represent amounts accumulated during

Q91: Pierce Company sold to Stanton Company merchandise

Q104: Jackson Industries has collected the following information

Q140: Roe's Renovations utilizes the direct write-off method

Q172: Cumberland Co. sells $2,000 of inventory to