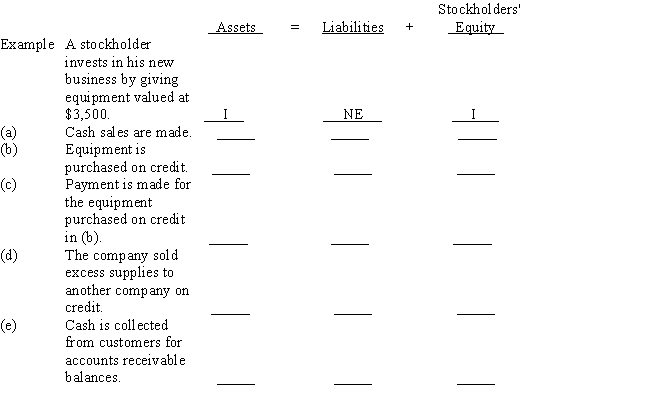

Several transactions are listed below, with the accounting equation stated to the right side of each. Use the following identification codes to indicate the effects of each transaction on the accounting equation. Write your answers in the space provided under the accounting equation. You need an identification code for each element of the accounting equation. An example is given before the first transaction.

Definitions:

Tax Laws

are the legal rules and regulations governing how individuals, businesses, and other entities are taxed by the government.

Capital Gains

The profit from the sale of a capital asset, such as stocks or real estate, over its purchase price.

Residual Dividend Policy

A strategy for setting dividend payments based on the firm's residual or leftover equity after funding all its investment projects.

Debt-Equity Ratio

A financial ratio that shows the relative amounts of shareholders' equity and debt financing used to fund a company's assets.

Q7: The account Unrealized Gain (Loss) on Available-for-Sale

Q8: Present entries to record the following

Q28: A journal with special and general columns.<br>A)accrual

Q39: Held-to-maturity securities maturing beyond a year are

Q40: Ruben Company purchased $100,000 of Evans Company

Q54: When bonds held as long-term investments are

Q76: Identify which of the following accounts should

Q132: The stockholders' rights to the assets rank

Q176: The following adjusted trial balance is the

Q201: In the accounting cycle, the last step