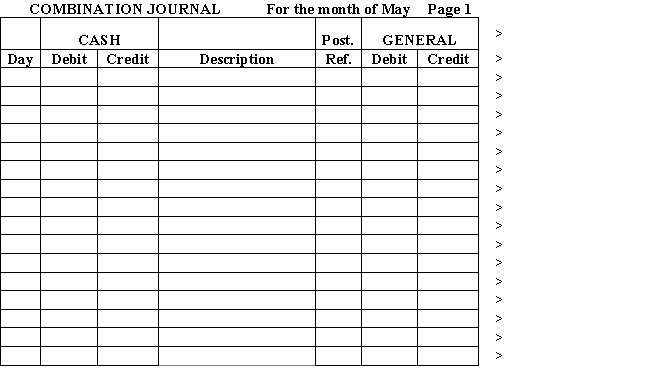

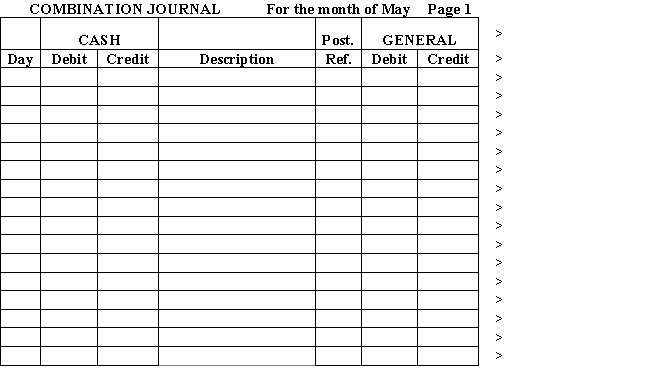

Record the following transactions for K-9 Kennel and Grooming Salon in a combination journal using the modified cash basis of accounting.Total,rule,and prove the combination journal.

?

May 1247815151718212425272931 Purchased shampoo supplies for $322 on account. Paid rent, $1,250. Cash received from customers for the week, $2,000. Purchased office equipment for $1,670. Paid $500 down and the remainder on account. Paid the tel ephone bill, $89. (Utility expense) Paid wages, $2,780. Billed credit customers, $3,250. Owner, K. Kennel, withdrew $1,000 cash for personal use. Paid for a one-year liability insurance policy, $1,250 Paid bill for shampoo supplies purchased on May 1 Cash received from customers for the week, $1,942. Paid for the office equipment bought on account. Billed credit customers, $2,270. Received el ectric bill, $244. Received $2,930 from credit customers. ?

<<<<<<<<<<<<<<<<< Day GROOMING FEES CREDIT SUPPLIES DEBIT WAGES EXPENSE DEBIT UTILITIES EXPENSE DEBIT

<<<<<<<<<<<<<<<<< Day GROOMING FEES CREDIT SUPPLIES DEBIT WAGES EXPENSE DEBIT UTILITIES EXPENSE DEBIT

Definitions:

Real Interest Rate

The interest rate adjusted for inflation, representing the true cost of borrowing and the real yield to lenders or investors.

Net Capital Outflow

The difference between the domestic country's purchase of foreign assets and the foreign purchases of the domestic country's assets over a specified period, reflecting the flow of capital across borders.

Capital Asset

A long-term asset such as equipment, real estate, or machinery that a company uses in its operations to generate wealth.

Loanable Funds

The market where savers provide funds to borrowers, usually influencing interest rates.