Mark Johnson opened a delivery service.His chart of accounts is shown below.

Required:

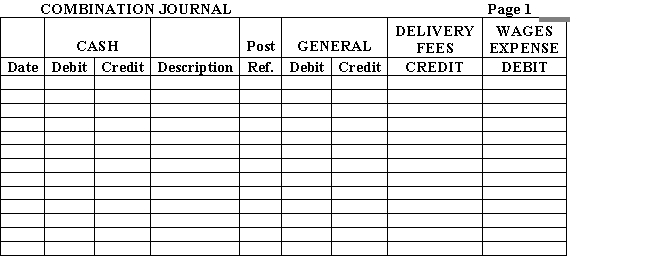

1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided.

2.Prove the combination journal.

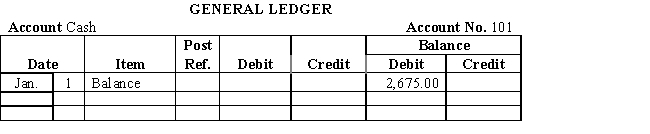

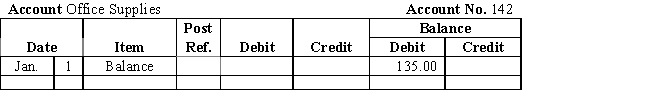

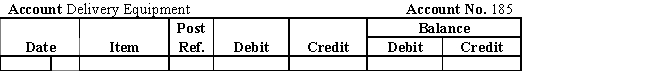

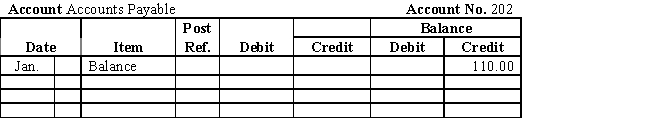

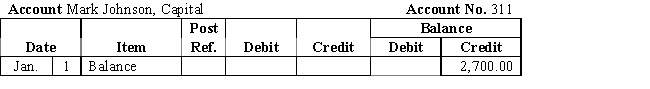

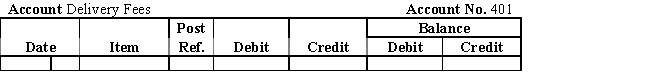

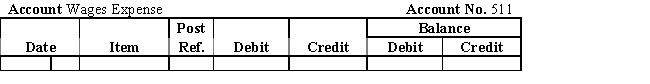

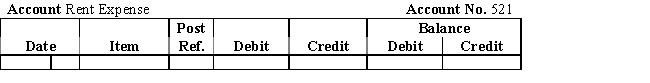

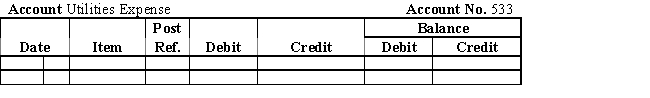

3.Post to the general ledger.

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" > Proving the Combination Journal

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" > Proving the Combination Journal

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" rel="preload" >

Definitions:

Expert

An individual with a deep, comprehensive knowledge or skill in a particular area or field.

Referent Power

A form of power that stems from being admired or respected, leading others to identify with the person who has referent power.

Identification

Conformity to a social norm prompted by perceptions that those who promote the norm are attractive or similar to oneself.

Job

A role or position that involves a set of tasks and responsibilities, typically in exchange for compensation.

Q2: The statement of owner's equity is prepared

Q20: Deposits that have not reached or been

Q25: Any person who agrees to perform a

Q34: On June 1, $40,000 of treasury bonds

Q54: A summary of cash flows for

Q69: Prepare a statement of stockholder's equity for

Q78: Employees usually pay the entire cost of

Q120: In some checkbooks,a document attached to a

Q236: Receiving a bill or otherwise being notified

Q248: Which of the items below is not