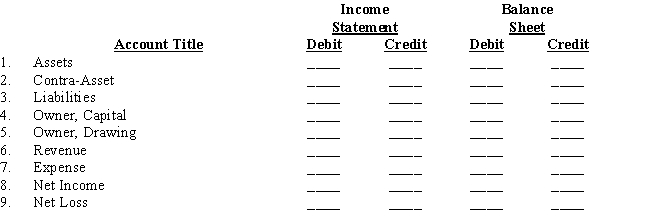

The Income Statement and Balance Sheet columns of a work sheet are produced below.Indicate with an "X" the specific Income Statement or Balance Sheet column(s)in which each amount transferred from the Adjusted Trial Balance columns should be placed,if at all.

Definitions:

Ethical Rules

Guidelines established by legal authorities to govern the conduct of lawyers and legal professionals.

Canons of Ethics

Guiding principles or standards of professional conduct for attorneys.

Ethical Regulation

Standards and guidelines established to govern the professional conduct and integrity of individuals in a certain profession, often applied to legal and medical fields.

ABA

Stands for the American Bar Association, a professional organization for lawyers and law students in the United States.

Q7: What type of not-for-profit (NFP)organization may be

Q14: Entering financial information about events affecting the

Q17: When services are performed for which payment

Q23: Under federal law,employers are required to withhold

Q38: A government business enterprise's net income or

Q64: The matching principle in accounting requires the

Q69: The second pair of columns on a

Q74: The form used to assemble the data

Q80: Any accounting period of twelve months' duration

Q96: The term "cash" has several different meanings.