All of the following statements are stated in Brazil reals (R$) .  Additional information:

Additional information:

Selected exchange rates:

Date of purchase of inventory on hand at year-end Dividends were declared on June 30, 20X5 Opening inventory = R$130,000

Inventory purchases for the year = R$1,570,000

Machinery, land, and buildings were purchased on June 30, 20X4

-

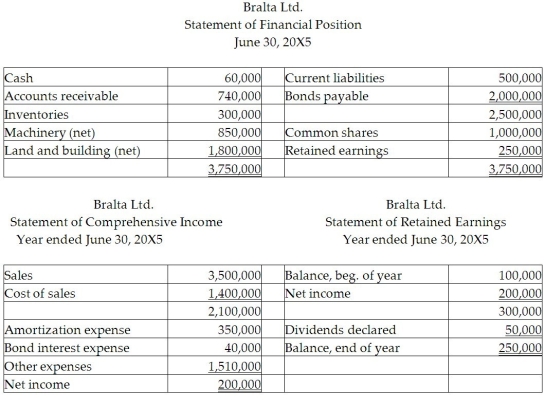

Bralta is the Brazilian subsidiary of Altapro Co., a Canadian company. Bralta had net assets at June 30, 20X4, of R$1,100,000. What is the cost of sales under the temporal method?

Definitions:

Excise Tax

A tax levied on certain goods, services, and activities, such as tobacco, alcohol, and fuel, usually to discourage their consumption and raise government revenue.

Local Property Tax

A tax assessed on real estate properties, usually levied by local government entities such as cities or counties.

Salary

A fixed regular payment, typically paid on a monthly or biweekly basis but often expressed as an annual sum, made by an employer to an employee.

Progressive Tax

A tax whose burden, expressed as a percentage of income, increases as income increases.

Q1: The process of making planned events actually

Q2: Source documents begin the process of entering

Q16: What is the best description of the

Q16: Townsend Ltd. has the following shareholders: Palermo

Q27: What valuation must government organizations use to

Q33: Projects can have multiple internal rates of

Q34: What is the assessment method widely used

Q55: Which outlay does not appear in the

Q63: How is a budget best defined?<br>A)As a

Q67: On what should the decision to invest