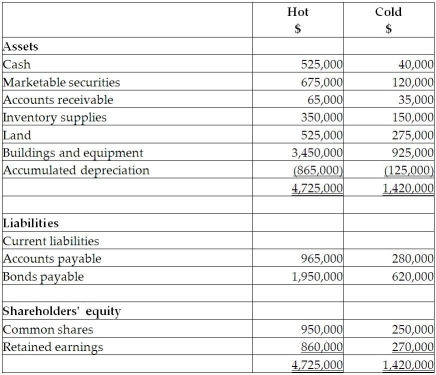

On September 1, 20X5, Hot Limited decided to buy 80% of the shares outstanding of Cold Inc. for $850,000. Hot paid for this acquisition by using cash of $500,000 and marketable securities for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X5, are as follows:  After a review of the financial assets and liabilities, Hot determines that some of the assets of Cold have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, Hot determines that some of the assets of Cold have fair values different from their carrying values. These items are listed below:

• Inventory has a fair value of $130,000.

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• A trademark has a fair value of $300,000. The trademark is estimated to have a useful life of 15 years.

• The bonds payable have a fair value of $720,000 and are due on August 31, 20X9.

During the 20X9 fiscal year, the following events occurred:

1. Hot sold merchandise to Cold for $200,000. Profit margin on these sales was 30%. Cold still has inventory on hand of $70,000. Included in the opening inventory of Cold for 20X9 is merchandise purchased from Hot in 20X8 for $150,000. The gross profit margin on these sales was 30%

2. Cold sold merchandise to Hot for $500,000. The gross margin on these sales was 40%. At the end of the year, $180,000 of this was still in Hot's inventory and Hot still owed $100,000 on these sales. Included in the opening inventory of Hot for 20X9 was merchandise purchased from Cold in 20X8 for $230,000. The profit margin on these sales was 30%.

3. During 20X9, Cold sold to Hot equipment resulting in a gain to Cold of $75,000. At the time, the original cost and accumulated depreciation to date for the equipment on Cold's books were $510,000 and 160,000. The remaining useful life for this equipment is 15 years. Depreciation is fully recorded in the year of purchase, and no depreciation is recorded in the year of disposal by both companies.

4. During 20X9, Cold paid management fees of $450,000 to Hot.

5. During 20X9, Cold paid dividends of $400,000 and Hot paid dividends of $600,000.  Required:

Required:

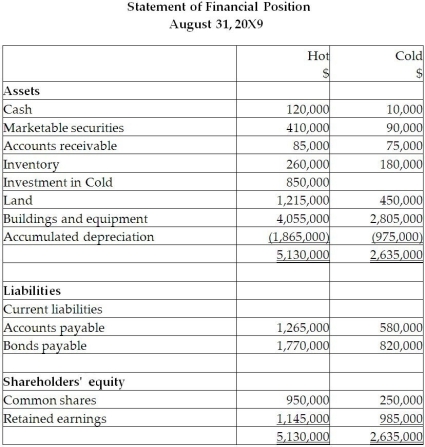

Prepare the consolidated statement of financial position for Hot at August 31, 20X9. Calculate the closing balance for the retained earnings and the non-controlling interest. The company used the entity method to determine goodwill for this acquisition.

Definitions:

Social Perception

The process by which people form impressions and make inferences about other individuals and groups.

Stereotypes

Overgeneralized beliefs about a particular category of people, which can lead to biased attitudes and beliefs about individuals based on their group membership.

Generalizations

Statements or conclusions drawn from specific instances that apply broadly to many situations, often used to simplify and understand complex realities.

Failure-Oriented

An approach or mindset focused on the potential for failure, often leading to risk-averse or cautious behavior.

Q1: At least 75% of an organization's consolidated

Q4: Castle Ltd. acquired 100% of Bello Ltd.

Q15: Interpreting refers to reviewing events that have

Q20: Entering financial information about events affecting the

Q31: The transportation fleet department for a provincial

Q31: Stockholders may have very little influence on

Q38: A government business enterprise's net income or

Q57: How are fixed costs represented graphically?<br>A)A horizontal

Q79: Deciding the meaning and importance of the

Q86: _ is the process by which accountants