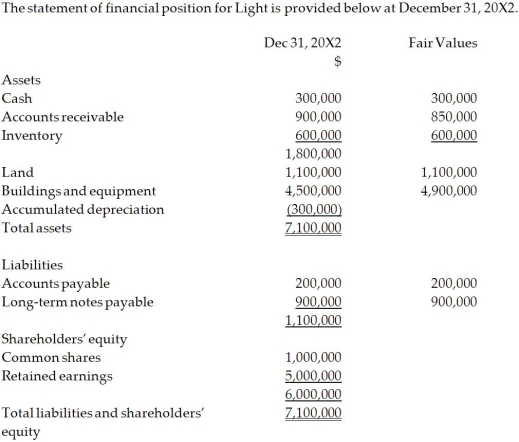

On December 31, 20X2, Dark Company purchased 75% of the outstanding common shares of Light Company for $6.0 million in cash. On that date, the shareholders' equity of Light totalled $6 million and consisted of $1 million in no par common shares and $5 million in retained earnings. Both companies use the straight-line method to calculate depreciation and amortization.  For the year ending December , the statements of comprehensive income for Dark and Light were as follows:

For the year ending December , the statements of comprehensive income for Dark and Light were as follows:

OTHER INFORMATION:

OTHER INFORMATION:

1. On December 31, 20X2, Light had a building with a fair value that was $4,900,000 and an estimated remaining useful life of 20 years.

2. On December 31, 20X2, Light had a trademark that had a fair value of $60,000. The trademark has an expected useful life of five years.

3. During 20X3, Light sold merchandise to Dark for $150,000, a price that included a gross profit of $50,000. During 20X3, 40% of this merchandise was resold by Dark and the other 60% remained in its December 31, 20X3, inventories.

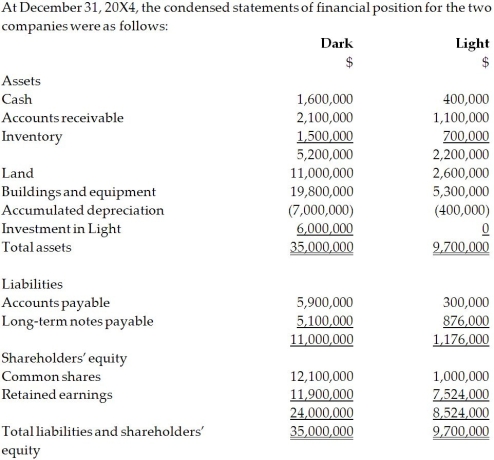

4. On December 31, 20X4, the inventories of Dark contained merchandise purchased from Light on which Light had recognized a gross profit in the amount of $20,000. Total sales from Light to Dark were $150,000 during 20X4.

5. During 20X4, Dark declared and paid dividends of $300,000 while Light declared and paid dividends of $100,000.

6. Dark accounts for its investment in Light using the cost method.

Required:

Calculate the non-controlling interest on the consolidated statement of financial position at December 31, 20X4, under the entity method.

Calculate the NCI's share of earnings for 20X4.

Definitions:

Stroboscopic Motion

Perceived motion created by the rapid presentation of static images in sequence, similar to how motion pictures work.

Autokinetic Illusion

A visual phenomenon where a stationary point of light in a dark environment appears to move because of involuntary eye movements.

Texture Gradient

A depth cue based on the gradual reduction of detail that occurs in surfaces as they recede from the observer, used in perception to judge distances.

Brightness

The attribute of visual perception according to which an area appears to emit more or less light.

Q2: In Canada, who developed the accounting standards

Q2: What does a funds-flow statement measure?<br>A)Exchange gains/losses

Q7: On December 31, 20X2, Pipe Ltd.

Q7: Which financial statements are recommended by the

Q37: If actual sales are $96 000 and

Q45: Refer to the table above. The demand

Q51: The report which shows a firm's assets,liabilities,and

Q52: Which of the following could be the

Q53: Reviewing the operating and accounting control procedures

Q74: The statement of owner's equity shows the