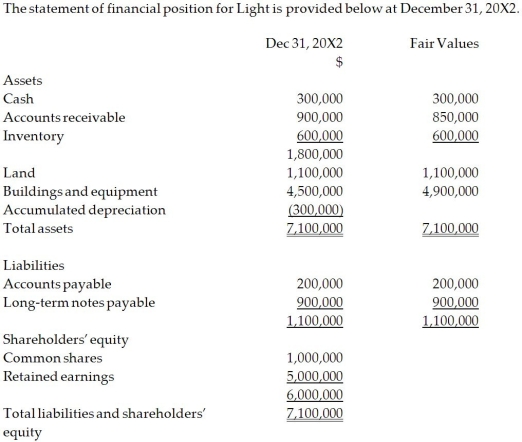

On December 31, 20X2, Dark Company purchased 75% of the outstanding common shares of Light Company for $6.0 million in cash. On that date, the shareholders' equity of Light totalled $6 million and consisted of $1 million in no par common shares and $5 million in retained earnings. Both companies use the straight-line method to calculate depreciation and amortization.  For the year ending December , the statements of comprehensive income for Dark and Light were as follows:

For the year ending December , the statements of comprehensive income for Dark and Light were as follows:

OTHER INFORMATION:

OTHER INFORMATION:

1. On December 31, 20X2, Light had a building with a fair value that was $4,900,000 and an estimated remaining useful life of 20 years.

2. On December 31, 20X2, Light had a trademark that had a fair value of $60,000. The trademark has an expected useful life of five years.

3. During 20X3, Light sold merchandise to Dark for $150,000, a price that included a gross profit of $50,000. During 20X3, 40% of this merchandise was resold by Dark and the other 60% remained in its December 31, 20X3, inventories.

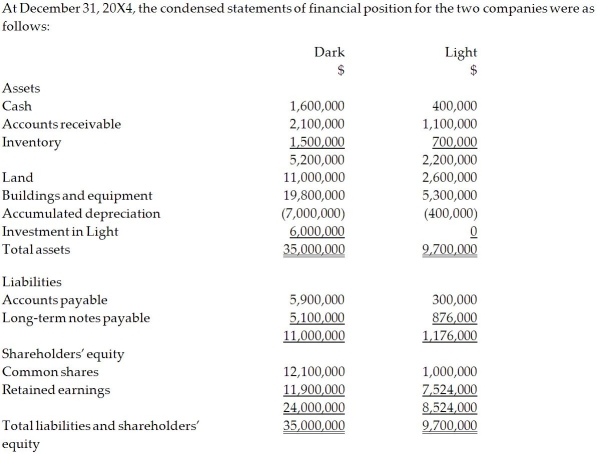

4. On December 31, 20X4, the inventories of Dark contained merchandise purchased from Light on which Light had recognized a gross profit in the amount of $20,000. Total sales from Light to Dark were $150,000 during 20X4.

5. During 20X4, Dark declared and paid dividends of $300,000, while Light declared and paid dividends of $100,000.

6. Dark accounts for its investment in Light using the cost method.

Required:

Calculate the retained earnings balance on the consolidated statement of financial position at December 31, 20X4, under the entity method.

Prepare the consolidated statement of financial position at December 31, 20X4.

Definitions:

Limited Liability Company

A business structure that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation.

Intellectual Property

A category of property that includes intangible creations of the human intellect, such as inventions, literary and artistic works, designs, and symbols, names and images used in commerce.

Parent Entity

A company that owns more than half of another company, making the latter a subsidiary.

Debt Financing

The raising of funds through borrowing, typically by issuing bonds or taking out loans, to finance an organization's operations or projects.

Q3: What deferred income tax adjustment must

Q7: When it is not clear what the

Q12: Bright School is a private school operating

Q16: What is the best description of the

Q16: NFP organizations can choose among reporting approaches

Q21: Which of the following is not a

Q22: Refer to the table above. The accounting

Q28: Required:<br>Assume that WBC's functional currency is

Q32: Refer to the table above. Assume that

Q68: Which statement is true?<br>A)The 'internal rate of