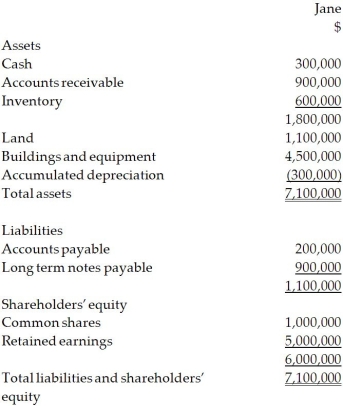

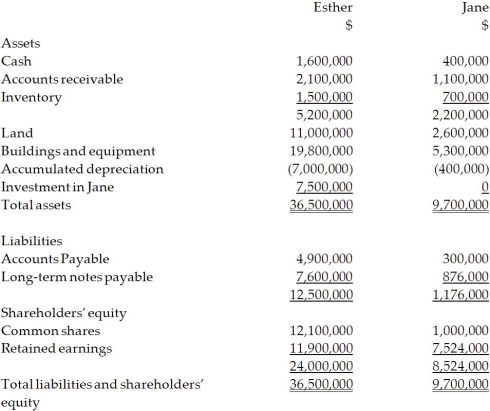

On December 31, 20X2, Esther Company purchased 80% of the outstanding common shares of Jane Company for $7.5 million in cash. On that date, the shareholders' equity of Jane totalled $6 million and consisted of $1 million in no par common shares and $5 million in retained earnings. Both companies use the straight-line method to calculate depreciation and amortization. The statement of financial position for Jane is provided below at December 31, 20X2.  For the year ending December 31, 20X4, the statements of comprehensive income for Esther and Jane were as follows: At December 31, 20X4, the condensed statement of financial position for the two companies were as follows:

For the year ending December 31, 20X4, the statements of comprehensive income for Esther and Jane were as follows: At December 31, 20X4, the condensed statement of financial position for the two companies were as follows:  OTHER INFORMATION:

OTHER INFORMATION:

1. On December 31, 20X2, Jane had a building with a fair value that was $450,000 greater than its carrying value. The building had an estimated remaining useful life of 15 years.

2. On December 31, 20X2, Jane had inventory with a fair value that was $150,000 less than its carrying value. This inventory was sold in 20X3.

3. During 20X3, Jane sold merchandise to Esther for $100,000, a price that included a gross profit of $50,000. During 20X3, 40% of this merchandise was resold by Esther and the other 60% remained in its December 31, 20X3, inventories. On December 31, 20X4, the inventories of Esther contained merchandise purchased from Jane on which Jane had recognized a gross profit in the amount of $20,000. Total sales from Jane to Esther were $150,000 during 20X4.

4. During 20X4, Esther declared and paid dividends of $300,000, while Jane declared and paid dividends of $100,000.

5. Esther accounts for its investment in Jane using the cost method.

Required:

Calculate goodwill on the consolidated balance sheet at December 31, 20X4, under the entity method and the parent-company extension method. Explain the differences between the two balances.

Definitions:

Social Loafing

Social loafing is the phenomenon where individuals exert less effort when working in a group compared to when working alone.

Bystander Intervention

The act of stepping in to help someone in need when others present may not take action.

Social Running

refers to the activity of running in groups or communities, often for social interaction, peer support, and motivation rather than competitive purposes.

Informational Social Influence

The influence of others that leads an individual to conform because they believe the group is competent and has the correct information, especially in ambiguous situations.

Q3: The Khoo Music Society, a not-for-profit

Q3: During 20X1, Siro sold $7,000 of

Q8: Which of the following statements is true

Q20: LaSalle Ltd., a Canadian company, has a

Q26: Which of the following are combined to

Q34: Refer to the table above. The management

Q58: The excess of total revenues over total

Q60: In which step of the decision-making process

Q67: Telling the results of the financial information.<br>A)

Q70: A(n)_ is a separate record used to