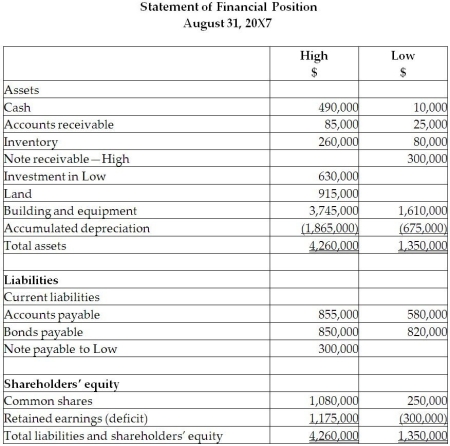

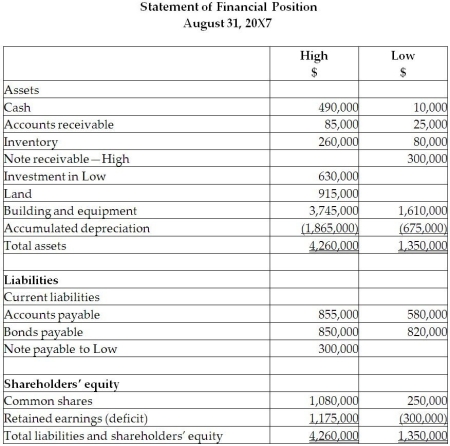

On September 1, 20X5, High Limited decided to buy 80% of the shares outstanding of Low Inc. for $630,000. High will pay for this acquisition by using cash of $500,000 and issuing share capital for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X5, are as follows: Cash Accounts receivable Inventory supplies Land Buildings and equipment Accumulated depreciation Total assets Liabilities Current liabilities Accounts payable Bonds payable Shareholders’ equity Common shares Retained earnings Total liabilities and shareholders’ equity High $525,00065,00050,000525,0003,450,000865,000)3,750,000665,0001,350,000950,000785,0003,750,000 Low $40,00035,00050,000275,000925,000125,0001,200,000280,000620,000250,00050,001,200,000

After a review of the assets and liabilities, High determines that some of the assets of Low have fair values different from their carrying values. These items are listed below:

• Land has a fair value of $295,000.

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• Brand value is $60,000. The brand has an indefinite life.

During the 20X7 fiscal year, the following events occurred:

1. On March 1, 20X7, Low sold land to High for $390,000, which had a carrying value of $275,000. High paid for this with $90,000 cash and a note payable for the difference. This note pays interest at 10%, which is paid monthly.

2. High sold inventory (included in High sales)to Low for $200,000. Profit margin on these sales is 25%. Low still has supplies on hand of $75,000.

3. In 20X6, Low had provided seat space on flights to High for a value of $500,000. This amount was included in sales for Low. Profit margin on these sales is 40%. At the end of August, 20X6, High still had an amount of $200,000 in these prepaid seats that had not yet been used. (High includes this in inventory.)

4. The brand name was found to be impaired and an impairment loss of $40,000 was recognized.  Statement of Comprehensive Income Year Ended August 31, 20X7 Sales Gain on sale of land Interest income Cost of sales Depreciation and amortization expenses Interest expense Management fees Other expenses Net income ( loss) High $6,560,000006,560,0004,980,000250,00015,000565,0005,810,000750,000 Low $1,540,000115,00015,0001,670,0001,030,000125,0001,040,0002,195,000(525,000) Required:

Statement of Comprehensive Income Year Ended August 31, 20X7 Sales Gain on sale of land Interest income Cost of sales Depreciation and amortization expenses Interest expense Management fees Other expenses Net income ( loss) High $6,560,000006,560,0004,980,000250,00015,000565,0005,810,000750,000 Low $1,540,000115,00015,0001,670,0001,030,000125,0001,040,0002,195,000(525,000) Required:

Calculate the balances for the following consolidated balances of High assuming High uses the parent-company extension method approach:

a. Goodwill at August 31, 20X5

b. Retained earnings at August 31, 20X7

c. Brand name, net, at August 31, 20X7.

Definitions:

Treasury Securities

Government-issued debt instruments that are used to finance the national debt, offering a secure investment with fixed interest payments.

Closing Stock Quote

The final price at which a stock is traded during a particular trading day or session on a securities exchange.

Real Rate

The interest rate adjusted for inflation, providing an idea of the true return on an investment.

Inflation Rate

The percentage rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling.

Required:

Required: