On December 31, 20X5, Russel Co Required:

Calculate the Consolidated Retained Earnings as at December 31

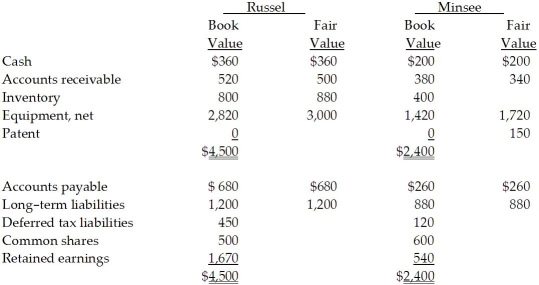

On December 31, 20X5, Russel Co. purchased 100% of the outstanding common shares of Minsee Ltd. for $1,300,000 in shares and $200,000 in cash. The statements of financial position of Russel and Minsee immediately before the acquisition and issuance of the notes payable were as follows (in 000s):  The tax value for each asset and liability is the same as its carrying value except for the equipment, which has a tax value of $950,000, and the patent, which has a tax value of nil. The equipment has a remaining useful life of 15 years from the date of acquisition. The patent has a useful life estimated to be five years from the date of acquisition.

The tax value for each asset and liability is the same as its carrying value except for the equipment, which has a tax value of $950,000, and the patent, which has a tax value of nil. The equipment has a remaining useful life of 15 years from the date of acquisition. The patent has a useful life estimated to be five years from the date of acquisition.

During 20X6, the year following the acquisition, the following occurred:

1. Minsee borrowed $350,000 from Russel on June 1, 20X6, and was charged interest at 10% per annum, which it paid on a monthly basis. There were no repayments of principal made during the remaining of the year.

2. Throughout the year, Minsee purchased merchandise of $800,000 from Russel. Russel's gross margin is 30% of selling price. At December 31, 20X6, Minsee still owed Russel $250,000 on this merchandise; 75% of this merchandise was resold by Minsee prior to December 31, 20X6.

3. Minsee paid dividends of $275,000 at the end of 20X6 and Russel paid dividends of $200,000.

4. Minsee and Russel both have an income tax rate of 30%.

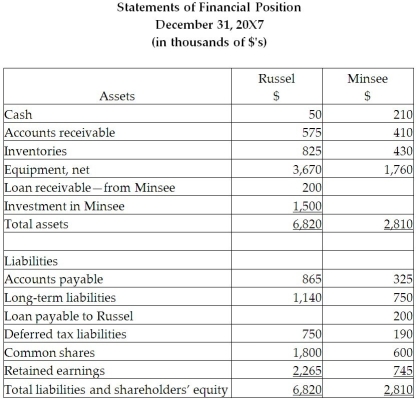

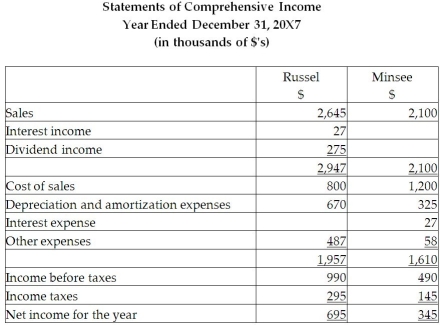

During 20X7, the following occurred:

1. Minsee paid $150,000 on the loan payable to Russel on May 30, 20X7.

2. Throughout the year, Minsee purchased merchandise of $1,000,000 from Russel. Russel's gross margin is 30% of selling price. At December 31, 20X6, Minsee still owed Russel $150,000 on this merchandise; 85% of this merchandise was resold by Minsee prior to December 31, 20X7.

3. Minsee paid dividends of $275,000 at the end of 20X7 and Russel paid dividends of $200,000.

4. Minsee and Russel both have an income tax rate of 30%.

Required:

Required:

Calculate the consolidated retained earnings as at December 31, 20X7, and as at December 31, 20X6.

Prepare the consolidated statement of comprehensive income and the consolidated statement of financial position for the year ended December 31, 20X7, for Russel. Include all relevant income tax calculations.

Definitions:

Discount

A reduction in the price of goods or services, typically offered to encourage purchases.

Face Value

the nominal value or original cost of a security as stated by the issuing authority, not necessarily its market value.

Proceeds

The total amount of money received from a sale or transaction.

Discount

A reduction in the price of a product or service, usually to encourage sales or as an allowance for prompt payment.

Q1: At least 75% of an organization's consolidated

Q5: Which ratios are specifically concerned with assessing

Q7: Prawn Corporation owns 80% of the

Q13: Why may management justifiably hesitate to close

Q18: What exchange rate is usually used to

Q20: World Doctors (WD)is a not-for-profit organization that

Q25: Operating profit before interest and taxation, divided

Q32: Which of the following does the Net

Q34: Amounts owed to the business by its

Q35: What accounting standards are private banks and