On December 31, 20X5, Russel Co Required:

Calculate the Consolidated Retained Earnings as at December 31

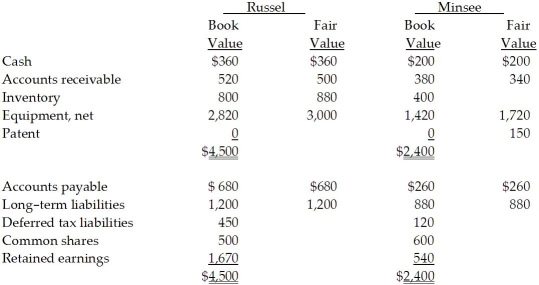

On December 31, 20X5, Russel Co. purchased 100% of the outstanding common shares of Minsee Ltd. for $1,300,000 in shares and $200,000 in cash. The statements of financial position of Russel and Minsee immediately before the acquisition and issuance of the notes payable were as follows (in 000s):  The tax value for each asset and liability is the same as its carrying value except for the equipment, which has a tax value of $950,000, and the patent, which has a tax value of nil. The equipment has a remaining useful life of 15 years from the date of acquisition. The patent has a useful life estimated to be five years from the date of acquisition.

The tax value for each asset and liability is the same as its carrying value except for the equipment, which has a tax value of $950,000, and the patent, which has a tax value of nil. The equipment has a remaining useful life of 15 years from the date of acquisition. The patent has a useful life estimated to be five years from the date of acquisition.

During 20X6, the year following the acquisition, the following occurred:

1. Minsee borrowed $350,000 from Russel on June 1, 20X6, and was charged interest at 10% per annum, which it paid on a monthly basis. There were no repayments of principal made during the remaining of the year.

2. Throughout the year, Minsee purchased merchandise of $800,000 from Russel. Russel's gross margin is 30% of selling price. At December 31, 20X6, Minsee still owed Russel $250,000 on this merchandise; 75% of this merchandise was resold by Minsee prior to December 31, 20X6.

3. Minsee paid dividends of $275,000 at the end of 20X6 and Russel paid dividends of $200,000.

4. Minsee and Russel both have an income tax rate of 30%.

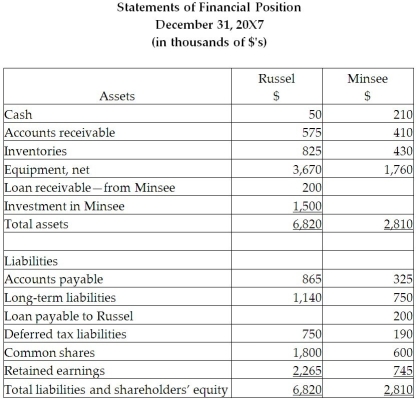

During 20X7, the following occurred:

1. Minsee paid $150,000 on the loan payable to Russel on May 30, 20X7.

2. Throughout the year, Minsee purchased merchandise of $1,000,000 from Russel. Russel's gross margin is 30% of selling price. At December 31, 20X6, Minsee still owed Russel $150,000 on this merchandise; 85% of this merchandise was resold by Minsee prior to December 31, 20X7.

3. Minsee paid dividends of $275,000 at the end of 20X7 and Russel paid dividends of $200,000.

4. Minsee and Russel both have an income tax rate of 30%.

Required:

Required:

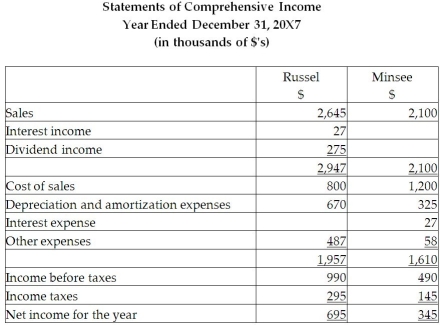

Calculate the consolidated retained earnings as at December 31, 20X7, and as at December 31, 20X6.

Prepare the consolidated statement of comprehensive income and the consolidated statement of financial position for the year ended December 31, 20X7, for Russel. Include all relevant income tax calculations.

Definitions:

Promotional Activities

Marketing efforts designed to communicate the value of a product or service to customers to boost sales.

Free Ride

The act of benefiting from a resource, good, or service without contributing to the cost or effort involved in its provision.

Reap Benefits

To receive or gain advantages, improvements, or positive outcomes as a result of actions taken or efforts made.

Customer Interest

The level of curiosity or concern that prospective buyers show towards a product or service, often a critical factor in marketing and sales strategies.

Q3: Castle Ltd. acquired 100% of Bello Ltd.

Q22: At December 31, what is the

Q30: Bateman uses the equity method

Q30: Which of the following is not one

Q33: Sharst Link Company (SLC)is a public company

Q39: Assume that the transaction qualifies as

Q39: Refer to the table above. The adverse

Q42: After an exchange of shares in a

Q46: Refer to the table above. What is

Q65: A(n)_ is owned by two or more