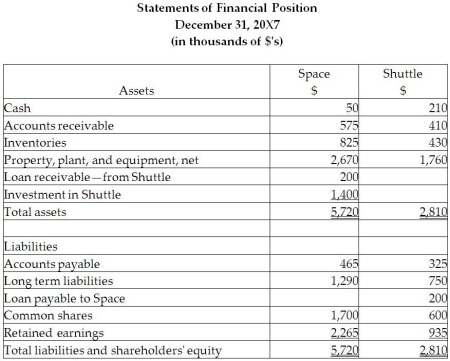

On December 31, 20X5, Space Co. purchased 100% of the outstanding common shares of Shuttle Ltd. for $1,200,000 in shares and $200,000 in cash. The statements of financial position of Space and Shuttle immediately before the acquisition and issuance of the notes payable were as follows (in 000s):

The difference in the carrying value and the fair value of the property, plant, and equipment for Shuttle relates to its office building. This building was originally purchased by Shuttle in January 20X1 and is being depreciated over 30 years.

During 20X6, the year following the acquisition, the following occurred:

1. Shuttle borrowed $350,000 from Space on June 1, 20X6, and was charged interest at 10% per annum, which it paid on a monthly basis. There were no repayments of principal made during the remaining of the year.

2. Throughout the year, Shuttle purchased merchandise of $800,000 from Space. Space's gross margin is 30% of selling price. At December 31, 20X6, Shuttle still owed Space $250,000 on this merchandise; 75% of this merchandise was resold by Shuttle prior to December 31, 20X6.

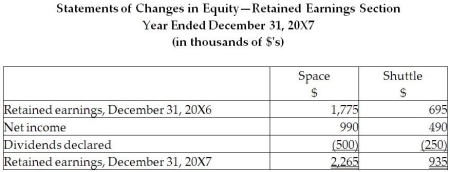

3. Shuttle paid dividends of $250,000 at the end of 20X6 and Space paid dividends of $500,000.

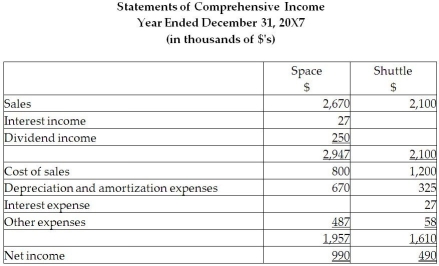

During 20X7, the following occurred:

1. Shuttle paid $150,000 on the loan payable to Space on May 30, 20X7.

2. Throughout the year, Shuttle purchased merchandise of $1,000,000 from Space. Space's gross margin is 30% of selling price. At December 31, 20X6, Shuttle still owed Space $150,000 on this merchandise; 85% of this merchandise was resold by Shuttle prior to December 31, 20X7.

3. Shuttle paid dividends of $250,000 at the end of 20X7 and Space paid dividends of $500,000.

Required:

Required:

Space has decided to record its investment in Shuttle using the equity method. Determine the balance in the Investment in Shuttle account at December 31, 20X7, using the equity method.

Prepare the statement of financial position and the statement of comprehensive income for the year ended December 31, 20X7, for Space, assuming it accounts for its investment in Shuttle using the equity method.

Definitions:

Effective Leader

A person who successfully guides and inspires others towards achieving shared goals through their actions and decisions.

Leadership Skills

A set of abilities that an individual can possess or develop to effectively guide, influence, or direct a group towards the achievement of goals.

Dominant Leaders

Individuals who assert control or influence over others in group settings, often setting direction and making decisions.

Prestigious Leaders

Leaders who are admired and respected due to their success, authority, or excellence in their field.

Q3: On what statement does the amortization of

Q6: Perez Co. acquired Roo Co. in a

Q14: Which of the following statements about the

Q14: Under the current-rate method, at what exchange

Q19: Which statement about the uses of budgets

Q21: Which of the following is not a

Q24: The Square Package Group is thinking of

Q35: Timothy Moore, Managing Director of Tiles Ltd,

Q37: The Wellness Society, a not-for-profit organization, owns

Q72: _ design the accounting information system and