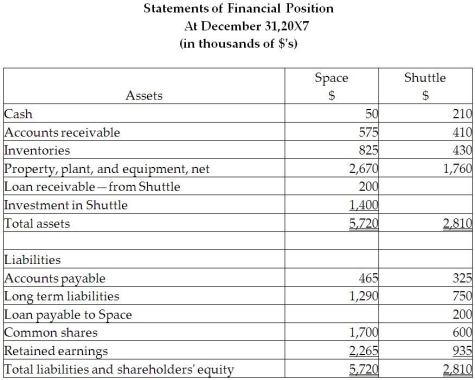

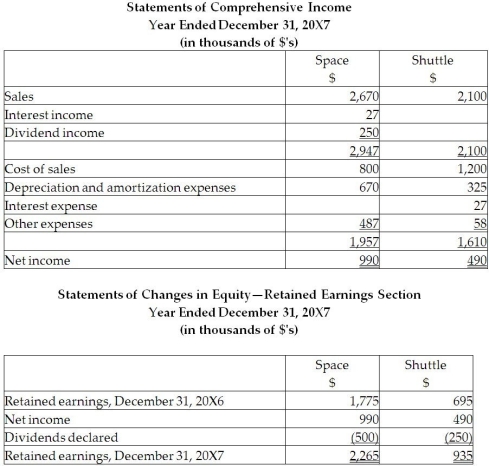

On December 31, 20X5, Space Co. purchased 100% of the outstanding common shares of Shuttle Ltd. for $1,200,000 in shares and $200,000 in cash. The statements of financial position of Space and Shuttle immediately before the acquisition and issuance of the notes payable were as follows (in 000s):

The difference in the carrying value and the fair value of the capital assets for Shuttle relates to its office building. This building was originally purchased by Shuttle in January 20X1 and is being depreciated over 30 years.

During 20X6, the year following the acquisition, the following occurred:

1. Shuttle borrowed $350,000 from Space on June 1, 20X6, and was charged interest at 10% per annum, which it paid on a monthly basis. There were no repayments of principal made during the remainder of the year.

2. Throughout the year, Space purchased merchandise of $800,000 from Shuttle. Shuttle's gross margin is 35% of selling price. At December 31, 20X6, Shuttle still owed Space $250,000 on this merchandise; 60% of this merchandise was resold by Space prior to December 31, 20X6.

3. Shuttle paid dividends of $250,000 at the end of 20X6 and Space paid dividends of $500,000.

During 20X7, the following occurred:

1. Shuttle paid $150,000 on the loan payable to Space on May 30, 20X7.

2. Throughout the year, Space purchased merchandise of $900,000 from Space. Space's gross margin is 35% of selling price. At December 31, 20X6, Shuttle still owed Space $350,000 on this merchandise; 80% of this merchandise was resold by Shuttle prior to December 31, 20X7.

3. The goodwill was tested and found to be impaired, resulting in an impairment loss of $120,000.

4. Shuttle paid dividends of $250,000 at the end of 20X7 and Space paid dividends of $500,000.

Required:

Required:

Calculate the consolidated retained earnings for Space as at December 31, 20X7.

Prepare the consolidated statement of financial position for the year ended December 31, 20X7, for Space.

Definitions:

Countertop Literature

Promotional or informational printed materials designed to be displayed on counters or tables, often in retail or service environments.

Premium

refers to the amount paid for an insurance policy or the additional cost above the normal price for a product or service perceived to be of higher quality.

CRM Software

Customer Relationship Management software; a tool that helps businesses manage, record, and evaluate their interactions with current and potential customers.

Transactional Selling

A sales approach focused on short-term transactions, emphasizing individual sales rather than building long-term relationships with customers.

Q3: On what statement does the amortization of

Q3: Ignoring income taxes, what accounts should

Q12: Sugar Corp and Syrup Limited have

Q16: The potential benefits forgone by rejecting one

Q16: Paranich Co. acquired Crowley Co. in a

Q18: In preparing a spreadsheet for a cost-volume-profit

Q31: Sya Ltd. acquired all the assets and

Q36: Refer to the table above. Total budgeted

Q48: What is the net exchange gain (loss)on

Q52: Refer to the table above. The overhead