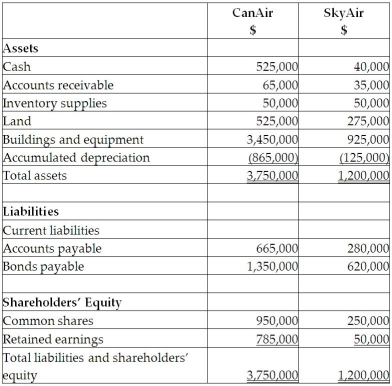

On September 1, 20X5, CanAir Limited decided to buy 100% of the shares outstanding of SkyAir Inc. for $900,000. CanAir will pay for this acquisition by using cash of $500,000 and issuing share capital for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X5, are as follows:  After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

• Land has a fair value of 225,000.

• The building has a fair value of $1,090,000. (The company does not own any equipment.)The remaining useful life of the building is 20 years.

• Internet domain name has a fair value is $55,000. The domain name is estimated to have a useful life of five years.

• Customer lists have a fair value is $35,000. It is estimated that the customer lists will have a useful life of seven years.

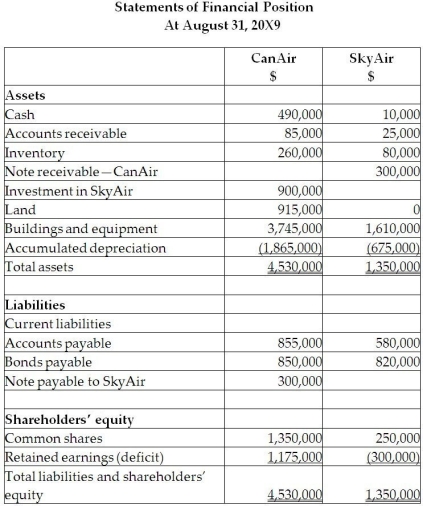

During the 20X9 fiscal year, the following events occurred:

1. On March 1, 20X9, SkyAir sold land to CanAir for $390,000, which had a carrying value of $275,000. CanAir paid for this with $90,000 cash and a note payable for the difference. This note pays interest at 10%, which is paid monthly.

2. CanAir provided management expertise to SkyAir and charged management fees of $890,000.

3. CanAir sold supplies (included in CanAir sales)to SkyAir for $200,000. CanAir charged SkyAir an amount that was 25% above cost. SkyAir still has supplies on hand of $70,000.

4. In 20X8, SkyAir provided seat space on flights to CanAir for a value of $500,000. This amount was included in sales for SkyAir. Profit margin on these sales is 40%. At the end of August, 20X8, CanAir still had an amount of $200,000 in these prepaid seats that had not yet been used. (CanAir includes this in inventory.)

Required:

Required:

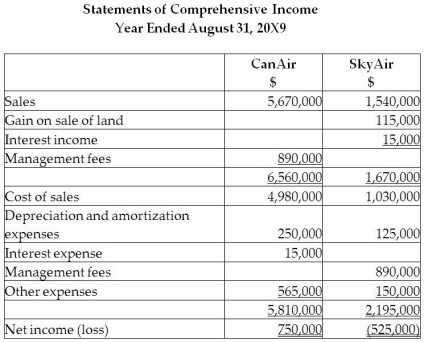

Prepare the consolidated statement of comprehensive income for the year ended August 31, 20X9.

Definitions:

Prospective

Relating to or effective in the future, often used in planning and forecasting scenarios.

Adjusting Entry

A journal entry made in accounting records at the end of an accounting period to allocate income and expenditure to the period in which they actually occurred.

Depreciation Expense

The portion of the cost of a fixed asset that is considered consumed in each period of the asset's useful life.

Retrospective Adjustments

Adjustments made to the financial statements of prior periods when adopting a new accounting principle, as if that principle had always been applied.

Q2: Bowen Limited purchased 60% of Sloch

Q2: Gumble Ltd. has owned 65% of the

Q4: Castle Ltd. acquired 100% of Bello Ltd.

Q8: What is a currency swap an example

Q14: With respect to interim financial statements, which

Q16: Generally supervises the work of accounting clerks,helps

Q18: Research surveys have suggested that there are

Q23: In a not-for-profit organization, donated capital assets

Q47: Which of the following statements about hedge

Q84: Which budget criticism can be dealt with