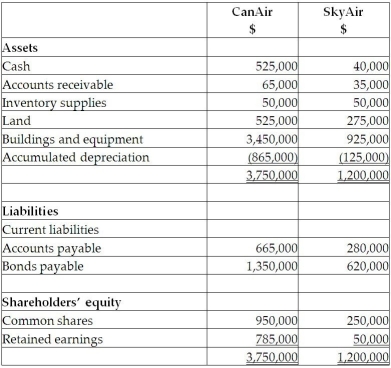

On September 1, 20X5, CanAir Limited decided to buy 100% of the shares outstanding of SkyAir Inc. for $500,000. Can Air will pay for this acquisition by using cash of $500,000. The balances showing on the statement of financial position for the two companies at August 31, 20X5, are as follows:  After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• Internet domain name has a fair value is $55,000. The domain name is estimated to have a useful life of five years.

• Brand name has a fair value is $65,000 and an indefinite life.

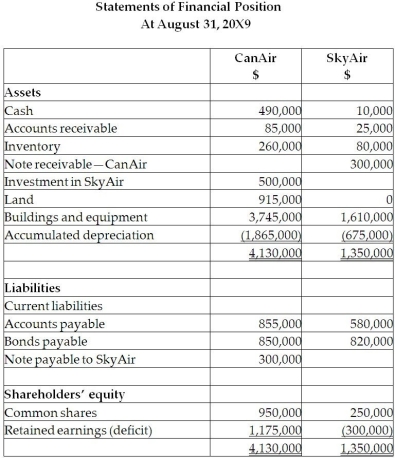

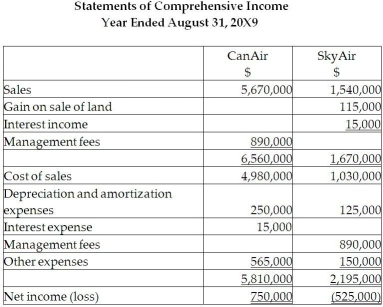

During the 20X9 fiscal year, the following events occurred:

1. On March 1, 20X9, SkyAir sold land to CanAir for $390,000, which had a carrying value of $275,000. CanAir paid for this with $90,000 cash and a note payable for the difference. This note pays interest at 10%, which is paid monthly.

2. CanAir provided management expertise to SkyAir and charged management fees of $890,000.

3. CanAir sold supplies (included in CanAir sales)to SkyAir for $200,000. CanAir charged SkyAir an amount that was 25% above cost. SkyAir still has supplies on hand of $20,000.

4. In 20X8, SkyAir provided seat space on flights to Can Air for a value of $300,000. This amount was included in sales for SkyAir. Profit margin on these sales is 30%. At the end of August, 20X8, CanAir still had an amount of $150,000 in these prepaid seats that had not yet been used. (CanAir includes this in inventory.)

Required:

Required:

CanAir would like to report this investment in SkyAir using the equity method.

Determine the income from this equity investment for the year.

Determine the balance in the Investment in SkyAir account if the company used the equity method.

Definitions:

Marginal Costs

The additional cost incurred by producing one more unit of a product or service.

Average Total Cost

The total cost of production divided by the quantity of output produced.

Market Price

The current price at which an asset or service can be bought or sold in a particular marketplace.

Marginal Costs

Marginal costs refer to the added expense required to manufacture or produce one additional unit of a product or service.

Q3: For gains on intercompany bond holdings, which

Q6: Required:<br>Assume that the forward contract is designated

Q17: Jordan made a $100,000 contribution to the

Q18: A separate record used to summarize changes

Q18: Records of Recycling Ltd contain the

Q20: Assume that the transaction qualifies as

Q25: Which of the following accounts would be

Q27: Big Research Foundation is a large not-for-profit

Q28: Under IFRS, which of the following statements

Q66: Which of the following statements is true?<br>A)The