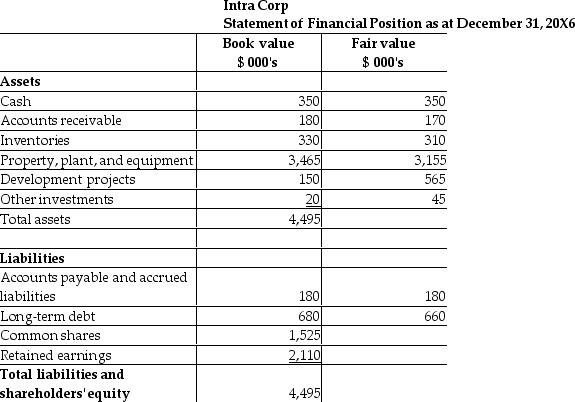

On January 1, 20X7, Falcon acquired the net assets of Intra for $3,400,000 with the issue of shares. The statement of financial position for Intra at the date of acquisition is shown below, together with estimates of the fair values of Intra's recorded assets and liabilities.

Required:

Required:

What is the amount of goodwill to be recorded for this business combination?

Prepare the journal entry that Falcon will use to record the business combination. Prepare the statement of financial position for Intra on January 1, 20X7, directly after the transaction is completed. Reconcile the book value of the retained earnings for Intra on December 31, 20X6, to its balance on January 1, 20X7. Explain any differences.

Definitions:

Budgeted

The process of creating a plan for a company's spendings and incomes over a specific period, typically including projected revenues, expenses, and net income.

Direct Labor Time Variance

The difference between the actual hours worked and the standard hours allowed for the work done, multiplied by the standard labor rate.

Direct Labor

The cost of wages for employees who directly manufacture or produce goods.

Unfavorable

A term used to describe outcomes or variances that negatively impact a business financially or operationally.

Q8: On what does the adequacy of the

Q8: At December 31, 20X0, Crowe Company has

Q9: The Public Sector Accounting Board (PSAB)has identified

Q9: Which of these ratios is not directly

Q13: Why may management justifiably hesitate to close

Q14: Semi-fixed costs are best defined as:<br>A)having both

Q17: The base for allocating overhead costs most

Q21: What is the essence of triple bottom

Q36: Earnings per ordinary share is:<br>A)$2.50<br>B)$3.00<br>C)$1.80<br>D)$1.50

Q36: Part 1: Helvetia Corp., a Swiss