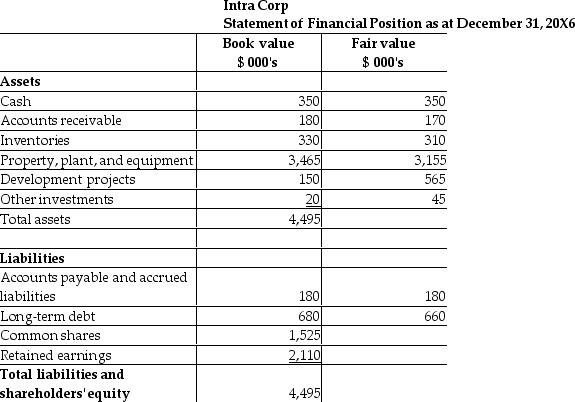

On January 1, 20X7, Falcon acquired the net assets of Intra for $3,400,000 with the issue of shares. The statement of financial position for Intra at the date of acquisition is shown below, together with estimates of the fair values of Intra's recorded assets and liabilities.

Required:

Required:

What is the amount of goodwill to be recorded for this business combination?

Prepare the journal entry that Falcon will use to record the business combination. Prepare the statement of financial position for Intra on January 1, 20X7, directly after the transaction is completed. Reconcile the book value of the retained earnings for Intra on December 31, 20X6, to its balance on January 1, 20X7. Explain any differences.

Definitions:

Investing Activities

Transactions involving the purchase and sale of long-term assets and other investments, not including cash equivalents.

Common Stock

A type of equity ownership in a corporation, representing claims on a portion of its earnings and assets, with voting rights on corporate matters.

Investing Activities

Transactions involving the purchase and sale of long-term assets and other investments, not including inventory, reported in the cash flow statement.

Financing Activities

Transactions that result in changes in the size and composition of the equity capital or borrowings of the entity.

Q5: Based on the organizations' objectives, which of

Q13: Lopez Ltd. purchases 65% of Wheatfall Co.

Q16: Preparing a CVP or break-even chart under

Q19: Activity-based costing can be used in:<br>A)a non-profit

Q33: Which of these is a factor that

Q34: <br>Machinery, land, and buildings were purchased on

Q36: A type of ownership structure in which

Q39: Which method of investment appraisal has been

Q41: In Canada, what entities must be included

Q47: All of the investment appraisal methods below