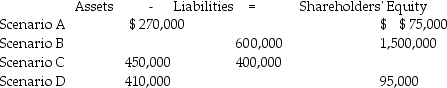

For each of the following independent scenarios, fill in the blanks with the appropriate dollar amount.

Definitions:

Hedge Ratio

A ratio used to measure the amount of exposure reduced by hedging, indicating the proportion of risk protected against price movements.

Delta

In the context of options and finance, delta measures the sensitivity of an option's price to changes in the price of the underlying asset.

Option's

Financial derivatives that grant the buyer the right, but not the obligation, to buy or sell an asset at a specified price before a certain date.

Time Value

Refers to the concept that money available at the present time is worth more than the same amount in the future due to its potential earning capacity.

Q3: What is the primary goal of management

Q20: An accrual refers to an event:<br>A) where

Q21: Calculate cost of sales if stock at

Q25: Which of the following statements regarding accounts

Q34: The part of shareholders' equity that may

Q69: If a bank statement included a bank

Q69: Which statement is true?<br>A)The statement of cash

Q81: Financing expenses are typically classified as an

Q104: The Bad Debt Expense account is classified:<br>A)

Q135: Revenues are:<br>A) increases in liabilities resulting from