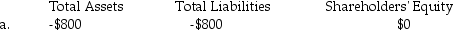

Given the following list of errors, determine the effect on assets, liabilities, and shareholders' equity by completing the chart below. Use (+) to indicate overstated, (-) to indicate understated, and (0) to indicate no effect. Transaction (a) is completed as an example.

a. The entry to record the purchase of $800 of equipment on account was never posted.

b. The entry to record the purchase of $100 of supplies for cash was posted as a debit to Supplies and a credit to Accounts Payable.

c. A $1,000 debit to Cash was posted as $100.

d. A $400 debit to the Accounts Payable account was never posted.

e. A debit to Accounts Receivable of $500 was posted as a credit to Accounts Receivable.

b.

b.

c.

d.

e.

Definitions:

Federal Unemployment Tax

A tax imposed on employers to fund state workforce agencies. Employers pay this tax to finance the unemployment compensation to workers who have lost their jobs.

Income Taxes

Taxes imposed by the government on the income generated by businesses and individuals.

Independent Contractors

Workers who provide services to a business under terms specified in a contract, not considered as employees of the company.

Misclassified

Incorrectly identified or categorized, often referring to an error in grouping data, information, or individuals based on attributes or characteristics.

Q16: The normal balance of Accounts Receivable is

Q20: What are 'held-for-trading investments'?

Q23: Net accounts receivable is calculated as:<br>A) sales

Q41: End of period adjustments are most often

Q48: Adjusting entries:<br>A) are prepared at the option

Q68: What is the major expense shown on

Q81: Financing expenses are typically classified as an

Q89: Which of the following persons or groups

Q95: Given the following information prepare the 2014

Q151: In the journal you will find the