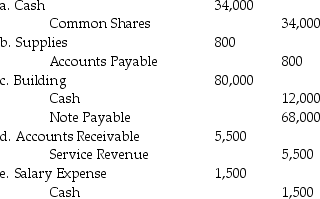

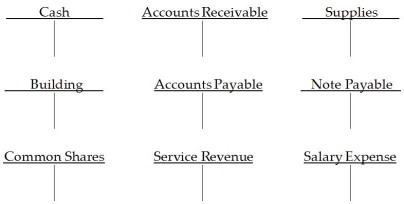

Post the following journal entries to the appropriate T-accounts, and show the resulting balance in each account.

Definitions:

Accrued Product Warranty

A liability representing the estimated costs of fulfilling product warranty obligations.

Pre-tax Book Income

The income of a company before taxes are deducted, as reported in its financial statements.

Deferred Tax

Deferred tax refers to taxes that are accrued but not yet paid due to timing differences between the recognition of income or expenses for financial reporting and tax purposes.

Financial Reporting

The process by which a company discloses its financial performance to stakeholders, including investors and regulators, typically through financial statements.

Q5: Which of the following items would not

Q8: Which statement about current value is true?<br>A)Current

Q30: If the expected ending cash balance is

Q33: The accounting principle that requires the same

Q34: Given a random list of accounts with

Q59: Performing a service on account would include

Q61: What is another name commonly used for

Q84: The accounting transaction to record payment of

Q120: When a company performs a service and

Q126: An improvement in the proportion of a