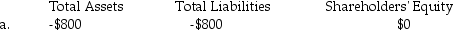

Given the following list of errors, determine the effect on assets, liabilities, and shareholders' equity by completing the chart below. Use (+) to indicate overstated, (-) to indicate understated, and (0) to indicate no effect. Transaction (a) is completed as an example.

a. The entry to record the purchase of $800 of equipment on account was never posted.

b. The entry to record the purchase of $100 of supplies for cash was posted as a debit to Supplies and a credit to Accounts Payable.

c. A $1,000 debit to Cash was posted as $100.

d. A $400 debit to the Accounts Payable account was never posted.

e. A debit to Accounts Receivable of $500 was posted as a credit to Accounts Receivable.

b.

b.

c.

d.

e.

Definitions:

Quick Ratio

A financial metric indicating a company's ability to meet short-term liabilities with its most liquid assets, excluding inventory.

Current Ratio

A financial metric used to measure a company's ability to pay its short-term liabilities with its short-term assets.

Debt Ratio

A financial ratio that compares the amount of debt a company has to its total assets.

Inventory Turnover Ratio

A measure of how many times a company's inventory is sold and replaced over a given period, indicating the efficiency of inventory management.

Q12: The December 31, 2014 unadjusted trial balance

Q22: Prepare journal entries in good form for

Q40: Management reports, compared to financial reports, are:<br>A)prepared

Q41: A purchase allowance is a decrease in

Q52: In a merchandising business, gross margin is

Q59: Receivables are monetary claims against others.

Q87: There are two basic ways to estimate

Q101: In a bank reconciliation, an EFT cash

Q103: All cash receipts should be deposited for

Q110: A journal entry contains a debit to