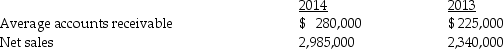

The following data are taken from the financial statements of Big Cedar Company:

70% of sales are on account. Terms for all credit sales are 2/10, n/30.

70% of sales are on account. Terms for all credit sales are 2/10, n/30.

Instructions

Definitions:

Interfirm Comparisons

The analysis and comparison of financial and operational data from different companies within the same industry, used to benchmark performance and practices.

Deferred Tax Assets

Financial items on a company's balance sheet that can be used to reduce future tax liability.

Deferred Tax Liabilities

Future tax liabilities arising from temporary differences between the book value and the tax basis of assets and liabilities.

Book Income Tax Expense

The amount of income tax expense that is reported in the financial statements, which may differ from actual taxes paid due to timing or differences in accounting and tax rules.

Q11: The controller (also called the chief accounting

Q14: The difference between total revenues and total

Q43: When performing vertical analysis, each financial statement

Q53: Following is a comparative balance sheet for

Q69: Earnings per share (EPS) is calculated by:<br>A)

Q96: If a managerial accountant suspected his or

Q101: Most financial analyses cover trends of three,

Q109: Which item is NOT a guideline used

Q124: All of the following are assumed in

Q191: Credibility includes maintaining an appropriate level of