Answer the following questions using the information below:

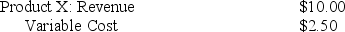

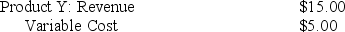

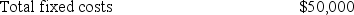

The following information is for Barnett Corporation:

-If the sales mix shifts to one unit of Product X and two units of Product Y, then the breakeven point will:

Definitions:

Market Rate

The market rate, often related to interest or exchange rates, is the prevailing rate determined by supply and demand dynamics in the open market.

Risk-free Rate

The theoretical rate of return on an investment with zero risk of financial loss, often represented by the yield on government securities.

Risk-free Asset

An investment that is expected to return its full original value along with a specified interest rate with virtually no risk of financial loss.

Q3: List the four standards of ethical conduct

Q37: When faced with a potential ethical conflict,

Q48: During October, Mayan produced 700,000 regular ceramic

Q104: As product diversity and indirect costs increase,

Q126: For last year, Wampum Enterprises reported revenues

Q145: How much of the gas cost will

Q149: Conversion costs include all direct manufacturing costs.

Q157: Financing decisions deal with how to best

Q184: An example of a denominator reason for

Q186: The basic source document for direct manufacturing