Answer the following questions using the information below:

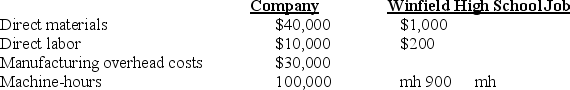

Gibson Manufacturing is a small textile manufacturer using machine-hours as the single indirect-cost rate to allocate manufacturing overhead costs to the various jobs contracted during the year. The following estimates are provided for the coming year for the company and for the Winfield High School band jacket job.

-For Gibson Manufacturing, what is the annual manufacturing overhead cost-allocation rate?

Definitions:

Probated

Referring to the legal process in which a will is reviewed to determine whether it is valid and authentic.

Option Contract

A contract that gives the holder the right, but not the obligation, to buy or sell an asset at a specified price within a specified period.

Legal Detriment

A loss or disadvantage that one party agrees to suffer upon entering into a contract, which serves as consideration for the contract.

Restatement

An authoritative secondary source providing a comprehensive summary of the common law and its applications in various legal cases.

Q64: Breakeven point in units is:<br>A)200 units<br>B)300 units<br>C)500

Q83: The plant has capacity for 3,000 axles

Q87: Most computer-based financial planning models have difficulty

Q93: What is the average manufacturing cost per

Q111: What are the total manufacturing costs of

Q136: The revenues budget identifies:<br>A)expected cash flows for

Q189: What is the journal entry used to

Q192: For a given job the direct costs

Q198: The advantage of using normal costing instead

Q207: What are the 2012 budgeted costs for