Answer the following questions using the information below:

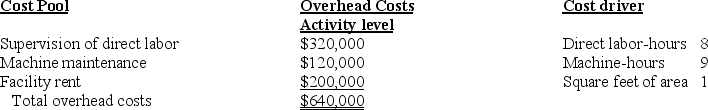

Gregory Enterprises has identified three cost pools to allocate overhead costs. The following estimates are provided for the coming year:

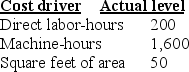

The accounting records show the Mossman Job consumed the following resources:

The accounting records show the Mossman Job consumed the following resources:

-If direct labor-hours are considered the only overhead cost driver, what is the single cost driver rate for Gregory Enterprises?

Definitions:

Accrual Basis

An accounting method that records income when earned and expenses when incurred, regardless of when the cash is received or paid.

Average Annual Gross Receipts

An average of a business's total gross income over a specified period, often used to determine tax reporting requirements or eligibility for small business tax concessions.

Complete Liquidation

The process of closing a business by selling all assets, paying off creditors, and distributing the remaining assets to shareholders.

Capital Gain

The profit from the sale of an asset or investment exceeding its purchase price, which is subject to taxation.

Q38: July's direct manufacturing labor price variance is:<br>A)$375.00

Q89: ABC assumes all costs are _ because

Q97: All of the following increase (are debited

Q103: ABC systems always provide decision-making benefits that

Q141: _ uses a "what-if" technique that examines

Q144: A cost-allocation base is a necessary element

Q145: How much of the gas cost will

Q160: If manufacturing machines are breaking down more

Q162: Margin of safety measures the difference between

Q177: Maddow Manufacturing is a small textile manufacturer