Answer the following questions using the information below:

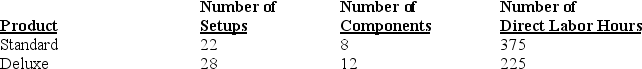

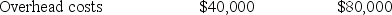

Fey Corporation manufactures two models of office chairs, a standard and a deluxe model. The following activity and cost information has been compiled:

-Number of setups and number of components are identified as activity-cost drivers for overhead. Assuming an activity-based costing system is used, what is the total amount of overhead costs assigned to the deluxe model?

Definitions:

Double-Entry Accounting

An accounting method requiring every financial transaction to be recorded in two accounts, one debit and one credit, to keep the accounting equation balanced.

Debits

Accounting entries that increase assets or expenses or decrease liabilities, equity, or revenue, recorded on the left side of an account.

Credits

Entries on the right-hand side of an accounting ledger, indicating increases in liability, equity accounts, and revenue, or a decrease in assets.

Debit Side

The left side of a ledger account that is used to record increases in assets, expenses, and decreases in liabilities, equity, and income.

Q5: The actual amount of manufacturing overhead costs

Q42: July's direct material price variance is:<br>A)$1,400 favorable<br>B)$1,100

Q64: The Work-in-Process Control account tracks job costs

Q133: What effect, and why, would an increase

Q144: What is budgeted sales for 2012?<br>A)$291,200<br>B)$262,080<br>C)$252,000<br>D)$280,000

Q145: What is budgeted gross margin for March

Q157: A primary reason for assigning selling and

Q169: Responsibility accounting focuses on control, NOT on

Q181: The following information pertains to Amigo Corporation:<br>

Q220: Christy Enterprises reports the year-end information from