Answer the following questions using the information below:

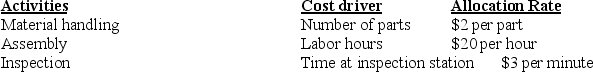

Nichols, Inc., manufactures remote controls. Currently the company uses a plant-wide rate for allocating manufacturing overhead. The plant manager believes it is time to refine the method of cost allocation and has the accounting department identify the primary production activities and their cost drivers:

The current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $200 per labor hour.

The current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $200 per labor hour.

-What are the indirect manufacturing costs per remote control assuming an activity-based-costing method is used and a batch of 100 remote controls are produced? The batch requires 500 parts, 10 direct manufacturing labor hours, and 5 minutes of inspection time.

Definitions:

Individualist Cultures

Cultures that emphasize personal independence and the self over group goals and cohesion.

Collectivist Cultures

Societies that prioritize the group over the individual, focusing on community, cooperation, and collective interests.

Aggressive Behavior

A pattern of actions or behaviors in which an individual may threaten or cause harm to another person or object.

Plutchik's Theory

A psychological theory that identifies eight primary emotions, which pair off into four sets of polar opposites, suggesting emotions drive human evolutionary adaptation.

Q35: The following data for the telephone company

Q38: Hill Manufacturing uses departmental cost driver rates

Q43: The actual costs of all individual overhead

Q52: Possible operational causes of an unfavorable direct

Q81: Mayberry Company had the following journal entries

Q90: What is the static-budget variance of operating

Q101: Using an ABC system, next year's estimates

Q103: Purchases budgeted for January total:<br>A)$130,800<br>B)$72,000<br>C)$69,840<br>D)$74,160

Q104: July's direct material flexible-budget variance is:<br>A)$1,400 unfavorable<br>B)$21,100

Q146: Waddell Productions makes separate journal entries for