Answer the following questions using the information below:

Velshi Printers has contracts to complete weekly supplements required by forty-six customers. For the year 2010, manufacturing overhead cost estimates total $840,000 for an annual production capacity of 12 million pages.

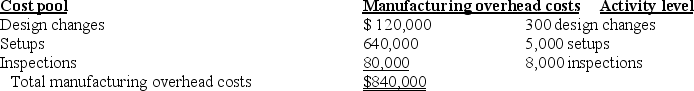

For 2010 Velshi Printers has decided to evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis:

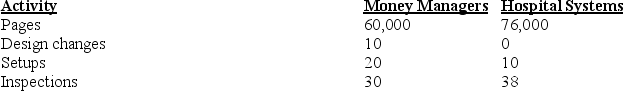

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

-Using pages printed as the only overhead cost driver, what is the manufacturing overhead cost estimate for Money Managers during 2010?

Definitions:

Geometric Average Return

The average compound return earned per year over a multi-year period.

Dividends

Payments made by a corporation to its shareholder members, representing a portion of the corporate profits.

Capital Gains Yield

The percentage change in the market price of an asset over a period, excluding dividends.

Shares

Shares represent units of ownership interest in a corporation or financial asset, providing a proportionate claim on its assets and profits.

Q9: Cost-volume-profit analysis assumes all of the following

Q17: An expected value is the weighted average

Q18: Proration is the spreading of underallocated or

Q52: For external reporting purposes, indirect manufacturing costs

Q54: One department indirect-cost rate is sufficient when:<br>A)activities

Q70: What are the actual direct-cost rate and

Q77: An unfavorable variance is conclusive evidence of

Q107: When refining a costing system, a company

Q143: Hammer Inc., had the following activities during

Q163: The amount of manufacturing overhead allocated to