Answer the following questions using the information below:

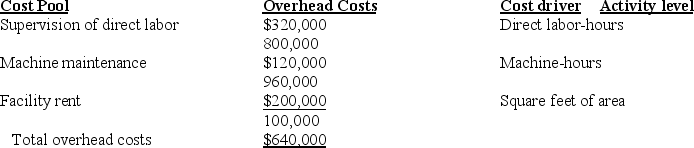

Gregory Enterprises has identified three cost pools to allocate overhead costs. The following estimates are provided for the coming year:

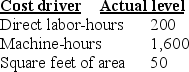

The accounting records show the Mossman Job consumed the following resources:

The accounting records show the Mossman Job consumed the following resources:

-It only makes sense to implement an ABC system when:

Definitions:

NonTaxable Income

Income that is not subject to taxation by the IRS or state tax authorities; examples include certain gifts, inheritances, and some types of insurance payouts.

Compensation

This represents payment or benefits provided to an employee or executive by an employer for services rendered.

Injuries

Physical harm or damage to a person's body.

Life Insurance Proceeds

The money paid out by a life insurance company to the beneficiary upon the insured's death.

Q7: Effectiveness is the relative amount of inputs

Q29: Number of setups and number of components

Q36: The materials handling activity-cost driver rate is:<br>A)$2.00<br>B)$20.00<br>C)$0.50<br>D)$5.00

Q43: ABC systems:<br>A)highlight the different levels of activities<br>B)limit

Q69: An example of a numerator reason for

Q90: A responsibility center is a part, segment,

Q100: What is the ending cash balance for

Q118: Process costing:<br>A)allocates all product costs, including materials

Q132: What is the total flexible-budget variance (D)?<br>A)$240

Q217: A primary consideration in assigning a cost