Answer the following questions using the information below:

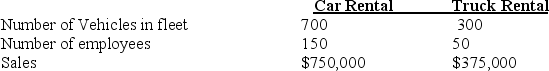

Monster Vehicle Rental Corporation has two departments, Car Rental and Truck Rental. Central costs may be allocated to the two departments in various ways.

-If the facility lease expense of $350,000 is allocated on the basis of vehicles in the fleet, the amount allocated to the Truck Rental Department would be:

Definitions:

Taxable Income

The amount of income used to calculate how much tax an individual or a company owes to the government in a specific tax year.

Warranty Expenses

Costs associated with the obligation to repair or replace products that fail to meet specified standards.

Interperiod Tax Allocation

The process of distributing the tax effects of transactions over various accounting periods.

Warranty Expenses

Costs incurred by a company for repairing, replacing, or servicing products under warranty, recognized as a liability at the time of sale.

Q11: Building in budgetary slack includes:<br>A)overestimating budgeted revenues<br>B)underestimating

Q16: Events, as distinguished from actions, would include:<br>A)personnel

Q20: For each item below indicate the source

Q51: Littrell Company produces chairs and has determined

Q73: Costing systems with multiple cost pools are

Q92: When using variance for performance evaluation, managers

Q125: The goal of a properly constructed ABC

Q135: A job-cost record is a source document,

Q152: The following data for the Alma Company

Q224: A budget can do all of the