Answer the following questions using the information below:

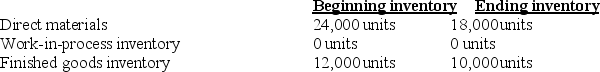

Beat, Inc., expects to sell 60,000 athletic uniforms for $80 each in 2012. Direct materials costs are $20, direct manufacturing labor is $8, and manufacturing overhead is $6 for each uniform. The following inventory levels apply to 2011:

-What is the amount budgeted for cost of goods sold in 2012?

Definitions:

Activity Cost Pools

Collections of overhead costs assigned to specific activities, used in activity-based costing to allocate costs more accurately.

Activity Rates

Rates used in activity-based costing to allocate costs to products or services based on the activities they require.

Activity-Based Costing

A costing methodology that assigns overhead and indirect costs to related products and services based on their usage of resources.

Direct Labor-Hours

The total hours worked directly on the manufacturing of goods.

Q24: Number of setups and number of components

Q37: When machine-hours are used as a cost-allocation

Q48: What is the total variable overhead variance<br>A)$7,875

Q62: The fixed overhead cost variance can be

Q86: Mount Carmel Company sells only two products,

Q95: An unfavorable production-volume variance always infers that

Q139: Financial planning software packages assist management with:<br>A)assigning

Q149: Explain the meaning of a favorable production-volume

Q153: How much of the gas cost will

Q160: Rachel's Pet Supply Corporation manufactures two models