Answer the following questions using the information below:

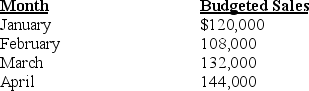

Wallace Company provides the following data for next year:

The gross profit rate is 40% of sales. Inventory at the end of December is $21,600 and target ending inventory levels are 30% of next month's sales, stated at cost.

The gross profit rate is 40% of sales. Inventory at the end of December is $21,600 and target ending inventory levels are 30% of next month's sales, stated at cost.

-St. Claire Manufacturing expects to produce and sell 6,000 units of Big, its only product, for $20 each. Direct material cost is $2 per unit, direct labor cost is $8 per unit, and variable manufacturing overhead is $3 per unit. Fixed manufacturing overhead is $24,000 in total. Variable selling and administrative expenses are $1 per unit, and fixed selling and administrative costs are $3,000 in total. According to generally accepted accounting principles, inventoriable cost per unit of Big would be:

Definitions:

Cognitive Sophistication

The level of complexity, understanding, and awareness that an individual has regarding various topics or concepts.

Dietary Restrictions

Limitations on the consumption of certain foods or ingredients based on medical, ethical, or personal reasons.

Diabetes

A group of diseases characterized by high levels of blood glucose resulting from defects in insulin production, insulin action, or both.

Cardiovascular Disease

A general term for conditions affecting the heart and blood vessels, such as coronary artery disease, heart attack, and stroke.

Q2: When continuous improvement budgeted costing is implemented,

Q19: _ is the usual starting point for

Q45: Favorable overhead variances are always recorded with

Q47: The master budget is one type of

Q106: Put the following ABC implementation steps in

Q110: The president of the company, Gregory Peters,

Q124: Casey Corporation produces a special line of

Q161: If we decrease the selling price of

Q170: On the 2012 budgeted income statement, what

Q198: Budgeted manufacturing overhead costs include all types