Answer the following questions using the information below:

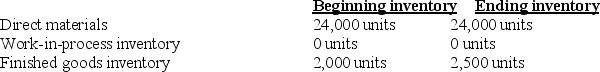

Kason, Inc., expects to sell 20,000 pool cues for $24.00 each. Direct materials costs are $4.00, direct manufacturing labor is $8.00, and manufacturing overhead is $1.60 per pool cue. The following inventory levels apply to 2011:

-On the 2012 budgeted income statement, what amount will be reported for cost of goods sold?

Definitions:

Dividends

Distributions of profits from a corporation to its shareholders, typically in the form of payments.

Par Value

A nominal value assigned by the issuer that represents the minimum price at which shares can be issued, often used in the context of stocks or bonds.

Fair Market Value

The estimated price at which an asset or service would exchange hands between a willing buyer and seller, both having reasonable knowledge of the relevant facts.

Par Value

The nominal or face value of a bond, share of stock, or coupon as indicated on a bond or stock certificate.

Q13: The flexible-budget variance is:<br>A)$7,500 favorable<br>B)$7,500 unfavorable<br>C)$1,200 unfavorable<br>D)$1,200

Q47: Ballpark Concessions currently sells hot dogs. During

Q47: Assume a traditional costing system applies the

Q85: How much of the total costs will

Q86: Explain how a top-selling product may actually

Q107: When using a normal costing system, year-end

Q111: The sales-volume variance is due to:<br>A)using a

Q117: The revenues budget should be based on

Q126: A job-cost record uses information from:<br>A)a materials

Q223: Lubriderm Corporation has the following budgeted sales