Answer the following questions using the information below:

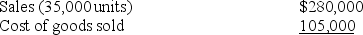

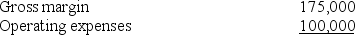

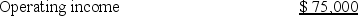

Brent Enterprises reports the year-end information from 2011 as follows:

Brent is developing the 2012 budget. In 2012 the company would like to increase selling prices by 4%, and as a result expects a decrease in sales volume of 10%. All other operating expenses are expected to remain constant. Assume that COGS is a variable cost and that operating expenses are a fixed cost.

Brent is developing the 2012 budget. In 2012 the company would like to increase selling prices by 4%, and as a result expects a decrease in sales volume of 10%. All other operating expenses are expected to remain constant. Assume that COGS is a variable cost and that operating expenses are a fixed cost.

-What is budgeted cost of goods sold for 2012?

Definitions:

Classical Conditioning

A learning process that occurs when two stimuli are repeatedly paired together; a response that is initially elicited by the second stimulus is eventually elicited by the first stimulus alone.

Unconditioned Stimulus

In classical conditioning, it's a stimulus that naturally and automatically triggers a response without any learning needed.

Fourth Of July

A federal holiday in the United States commemorating the adoption of the Declaration of Independence on July 4, 1776.

Firecrackers

Small explosive devices designed to produce a large amount of noise, especially in the form of a loud bang; typically used for entertainment or celebration.

Q10: Coffey Company maintains a very large direct

Q56: When designing a costing system, it is

Q64: The Work-in-Process Control account tracks job costs

Q80: What is the variable overhead spending variance?<br>A)$420

Q91: A favorable fixed overhead spending variance might

Q127: Absorption costing "absorbs" only fixed manufacturing costs.

Q132: The cash flow statement does NOT include:<br>A)cash

Q160: Responsibility accounting:<br>A)emphasizes controllability<br>B)focuses on whom should be

Q175: Lower-level managers will not actively participate in

Q196: Manufacturing costs estimated for Job #432 total:<br>A)$55,000<br>B)$65,000<br>C)$70,000<br>D)$75,000