Answer the following questions using the information below:

Lukehart Industries, Inc., produces air purifiers. Lukehart, Inc., produces the air purifiers in batches. To manufacture a batch of the purifiers, Lukehart, Inc., must set up the machines and assembly line tooling. Setup costs are batch-level costs because they are associated with batches rather than individual units of products. A separate Setup Department is responsible for setting up machines and tooling for different models of the air purifiers.

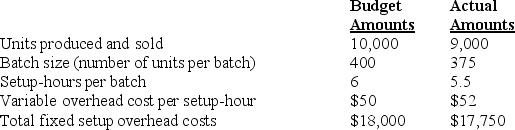

Setup overhead costs consist of some costs that are variable and some costs that are fixed with respect to the number of setup-hours. The following information pertains to June 2011:

-Calculate the spending variance for fixed setup overhead costs.

Definitions:

Balance Due

The outstanding amount of money owed by a debtor to a creditor, which remains unpaid after any initial payments or deductions have been applied.

Current Lease

An active leasing agreement specifying the terms under which a lessee occupies or utilizes the leased asset.

Evaluation

The systematic assessment of the value, performance, or quality of a plan or entity.

Straight-line Depreciation

A technique for distributing the expense of a physical asset uniformly throughout its estimated useful duration.

Q12: An unfavorable sales-volume variance could result from:<br>A)decreased

Q23: Write a linear cost function equation for

Q35: When using activity-based costing all of the

Q42: The cost components of a heater include

Q86: A rolling budget is the same as

Q106: Match each of the following items with

Q119: Budgetary slack provides management with a hedge

Q124: Budgeted fixed manufacturing costs of a product

Q160: The chapter shows that variance analysis of

Q200: _ method(s)include(s)fixed manufacturing overhead costs as inventoriable