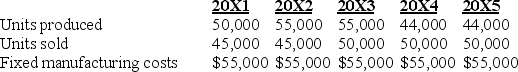

Galliart Company has two identical divisions, East and West. Their sales, production volume, and fixed manufacturing costs have been the same for the last five years. The amounts for each division were as follows:

East Division uses absorption costing and West Division uses variable costing.

East Division uses absorption costing and West Division uses variable costing.

Both use FIFO inventory methods.

Variable manufacturing costs are $5 per unit.

Selling and administrative expenses were identical for each division.

There were no inventories at the beginning of 20X1.

Which division reports the highest income each year? Explain.

Definitions:

Variances

The difference between planned or expected financial outcomes and the actual results.

Direct Materials

Raw materials that directly become a part of the finished product and can be easily traced to it.

Standard Cost

A predetermined cost of manufacturing a single unit or a number of product units during a specific period under current or anticipated operating conditions.

Direct Labor Variances

The differences between the actual costs of direct labor and the standard or expected costs, used for budgeting and cost control.

Q7: For a particular decision, differential revenues and

Q43: What is the variable overhead flexible-budget variance?<br>A)$600

Q54: Would you recommend the 50-cent price increase?<br>A)No,

Q84: All corporate-office allocated costs should be included

Q115: Assuming Product C is discontinued and the

Q138: Customers expect to pay a price that

Q143: The flexible-budget variance for variable costs is:<br>A)$16,000

Q175: Normal capacity utilization:<br>A)represents real capacity available to

Q192: In evaluating different alternatives, it is useful

Q216: Assuming no other use of their facilities,