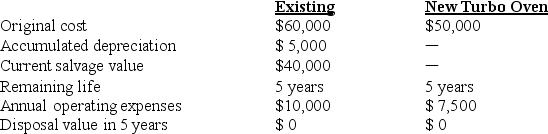

Pat, a Pizzeria manager, replaced the convection oven just six months ago. Today, Turbo Ovens Manufacturing announced the availability of a new convection oven that cooks more quickly with lower operating expenses. Pat is considering the purchase of this faster, lower-operating cost convection oven to replace the existing one they recently purchased. Selected information about the two ovens is given below:

Required:

Required:

a. What costs are sunk?

b. What costs are relevant?

c. What are the net cash flows over the next 5 years assuming the Pizzeria purchases the new convection oven?

d. What other items should Pat, as manager of the Pizzeria, consider when making this decision?

Definitions:

Final Settlement

Final Settlement refers to the conclusion of a financial transaction when the seller delivers the asset to the buyer and receives the agreed payment, fulfilling the contract's terms.

Profits and Losses

The financial gains or losses a company experiences, usually measured over a specific period of time.

Partnership Liquidation

The process of closing a partnership by distributing its assets to settle debts and then to the partners according to their ownership interests.

Gains and Losses

Financial terms referring to the positive or negative changes in value of investments or assets relative to their original purchase price.

Q12: The Internal Revenue Service requires the use

Q47: Which cost-allocation criterion is most likely to

Q55: Total factor productivity (TFP)is easy to compute

Q70: What is the estimated total cost at

Q89: The quantitative analysis method uses a formal

Q98: The demand for this product is:<br>A)greatly inelastic<br>B)slightly

Q142: Advantages of using the full cost of

Q159: Which of the following is an equation

Q166: Altec Company has relevant costs of $40

Q187: For short-run product-mix decisions, managers should focus