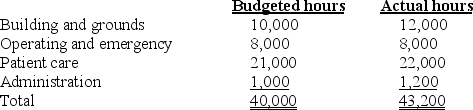

The fixed costs of operating the maintenance facility of General Hospital are $4,500,000 annually. Variable costs are incurred at the rate of $30 per maintenance-hour. The facility averages 40,000 maintenance-hours a year. Budgeted and actual hours per user for 20X3 are as follows:

Assume that budgeted maintenance-hours are used to calculate the allocation rates.

Assume that budgeted maintenance-hours are used to calculate the allocation rates.

Required:

a. If a single-rate cost-allocation method is used, what amount of maintenance cost will be budgeted for each department?

b. If a single-rate cost-allocation method is used, what amount of maintenance cost will be allocated to each department based on actual usage?

c. If a dual-rate cost-allocation method is used, what amount of maintenance cost will be budgeted for each department?

d. If a dual-rate cost-allocation method is used, what amount of maintenance cost will be allocated to each department based on actual usage? Based on budgeted usage for fixed operating costs and actual usage for variable operating costs?

Definitions:

Constructive Dismissal

A situation where an employee resigns due to the employer creating a hostile or unbearable work environment, effectively forcing the employee out.

Working Conditions

The environment and circumstances under which employees operate, including hours, physical aspects, legal rights, and safety.

Compensation

The total amount of the monetary and non-monetary pay provided to an employee by an employer in return for work performed.

Arbitration

A method of resolving disputes outside the courts, where a neutral third party makes a decision.

Q7: Calamata Corporation processes a single material into

Q16: The production method for recognizing byproducts is

Q22: Which of the following statement(s)concerning conversion costs

Q55: Under the incremental method, the first incremental

Q66: The net realizable value (NRV)method allocates joint

Q74: A major advantage of the weighted-average process

Q92: Under the dual-rate cost-allocation method, when fixed

Q97: Distinguish between the two principal methods of

Q119: A target price is the estimated price

Q120: Customer-profitability analysis is the reporting and assessment