Answer the following questions using the information below:

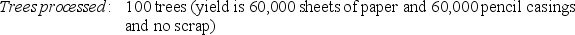

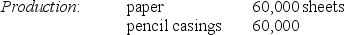

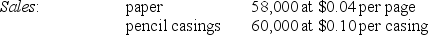

Yakima Manufacturing purchases trees from Cheney Lumber and processes them up to the splitoff point where two products (paper and pencil casings) are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of November:

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 60,000 sheets of paper and 60,000 pencil casings is $3,000.

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 60,000 sheets of paper and 60,000 pencil casings is $3,000.

Yakima's accounting department reported no beginning inventories and an ending inventory of 2,000 sheets of paper.

-What is the sales value at the splitoff point of the pencil casings?

Definitions:

Income Tax

A tax imposed by the government directly on individuals' or organizations' income.

Proportional Tax

At the individual level, a tax whose average tax rate remains constant as the taxpayer’s income increases or decreases. At the national level, a tax for which the average tax rate (= tax revenue/GDP) remains constant as GDP rises or falls.

Economy

The system by which a country's money and goods are produced and used, encompassing production, distribution, and consumption.

Tax-Transfer System

The mechanism through which governments collect taxes from individuals and businesses and redistribute the revenue in the form of government spending or transfers.

Q13: The stand-alone cost allocation method ranks the

Q32: When spoiled goods have a disposal value,

Q33: The Harleysville Manufacturing Shop produces motorcycle parts.

Q36: The support department allocation method that is

Q36: What is the direct materials cost per

Q80: Richard's Electronics manufactures TVs and DVDRs. During

Q81: When analyzing the change in operating income,

Q108: Companies that use manufacturing lead time as

Q121: If a dual-rate cost-allocation method is used,

Q135: The method that allocates costs by explicitly