Answer the following questions using the information below:

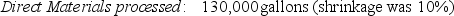

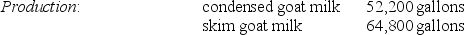

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

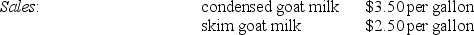

Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

-What is the estimated net realizable value of the skim goat ice cream at the splitoff point?

Definitions:

Global Leaders

Individuals who have the ability to influence and manage people and resources across geographies and cultures, often responsible for guiding multinational organizations.

Key Characteristics

Fundamental or essential attributes that define or distinguish something.

Global Leaders

Leaders who possess the skills and knowledge to effectively manage and lead organizations across diverse cultural, geopolitical, and economic contexts.

Work Experience

The accumulation of knowledge, skills, and competencies obtained through participation in paid or unpaid work activities.

Q12: The constant gross-margin percentage NRV method allocates

Q16: The only product of a company has

Q32: Any factor where a change in the

Q34: An item classified as spoilage has no

Q37: An analysis of Baker, Inc.'s operating income

Q78: Byproducts are recognized in the general ledger

Q96: For a fast-food restaurant, the average waiting

Q98: The sales value at splitoff method is

Q102: Using the step-down method, what amount of

Q103: To allocate corporate costs to divisions, the