Answer the following questions using the information below:

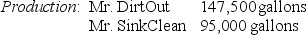

The Oxnard Corporation processes a liquid component up to the splitoff point where two products, Mr. DirtOut and Mr. SinkClean, are produced and sold. There was no beginning inventory. The following material was collected for the month of January:

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

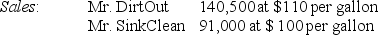

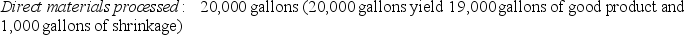

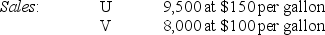

-Argon Manufacturing Company processes direct materials up to the splitoff point where two products (U and V) are obtained and sold. The following information was collected for last quarter of the calendar year:

The cost of purchasing 20,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 19,000 gallons of good products was $1,950,000.

The cost of purchasing 20,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 19,000 gallons of good products was $1,950,000.

Beginning inventories totaled 100 gallons for U and 50 gallons for V. Ending inventory amounts reflected 600 gallons of Product U and 1,050 gallons of Product V. October costs per unit were the same as November.

What are the physical-volume proportions for products U and V, respectively?

Definitions:

Dualism

A philosophical concept that sees mind and body as two distinct entities that interact and influence each other.

Brain

The central organ of the human nervous system, responsible for thought, memory, emotion, touch, motor skills, vision, breathing, temperature, hunger, and every process that regulates our body.

Reflex Arc

A neural pathway that mediates an automatic response to a stimulus, involving sensory input and motor output without conscious thought.

Dualistic Nature

The concept of two fundamental parts or principles, such as mind and body, in contrast or opposition.

Q36: In joint costing:<br>A)costs are assigned to individual

Q39: Customer actions will LEAST affect:<br>A)customer output unit-level

Q47: All of the following methods may be

Q65: In each of the following industries, identify

Q71: An activity-based costing system may focus on

Q75: Spoilage can be considered either normal or

Q88: Products with a relatively low sales value

Q95: What is the revenue effect of the

Q102: The most likely reason for NOT allocating

Q133: Marvelous Motors is a small motor supply